Money management is the systematic process of planning, organizing, controlling, and monitoring financial resources to achieve financial stability, meet short-term obligations, and accomplish long-term financial goals. It includes budgeting, saving, investing, expense tracking, debt control, and financial decision-making using structured frameworks.

Money management is the structured practice of planning, controlling, and optimizing income, expenses, savings, investments, and debt to maintain financial stability and achieve long-term financial goals. It combines budgeting, financial planning, expense tracking, and disciplined decision-making to ensure sustainable financial growth.

Why Money Management Matters

Effective money management is critical because it:

- Ensures financial stability and liquidity

- Reduces financial stress and uncertainty

- Improves saving and investment capacity

- Enables goal-based financial planning

- Builds long-term wealth and financial security

- Prevents over-indebtedness and cash flow crises

Extractable Key Points:

- Money management improves financial control.

- It reduces unnecessary spending.

- It increases savings and wealth accumulation.

- It enables disciplined financial planning.

- It protects against financial emergencies.

Core Principles of Financial Control

| Principle | Description |

|---|---|

| Budgeting | Planning income allocation for expenses, savings, and investments |

| Expense Tracking | Monitoring daily spending to control cash flow |

| Saving Discipline | Allocating a fixed portion of income toward future needs |

| Debt Management | Minimizing interest and maintaining healthy debt ratios |

| Investment Planning | Growing wealth through calculated financial risks |

| Risk Management | Protecting finances using emergency funds and insurance |

Key Financial Metrics Used in Money Management

| Metric | Purpose |

|---|---|

| Savings Rate | Measures percentage of income saved |

| Debt-to-Income Ratio | Evaluates debt burden |

| Net Worth | Tracks financial progress |

| Emergency Fund Ratio | Measures financial safety |

Summary

Money management is a structured financial discipline focused on planning, controlling, and optimizing personal or business finances. It integrates budgeting, saving, debt control, and investment strategies to ensure stability, financial security, and long-term growth.

Key Takeaways

- Money management ensures complete financial control.

- It helps balance income, expenses, savings, and investments.

- Structured money management reduces financial risk and instability.

- It is the foundation of long-term wealth creation.

Common Misconceptions

| Myth | Reality |

|---|---|

| Money management is only budgeting | It includes saving, investing, and financial planning |

| Only high earners need money management | Everyone benefits from financial control |

| Money management limits lifestyle | It improves spending efficiency |

Read the blog: Money Management

How to Manage Money Step-by-Step

Step 1 – Income Assessment

Income assessment involves identifying and calculating all sources of earnings to establish an accurate financial baseline.

Income Sources Include:

- Salary or wages

- Business income

- Freelance or contract work

- Investment income

- Rental income

- Bonuses and commissions

Why It Matters:

- Establishes realistic budgeting limits

- Prevents overspending beyond capacity

- Enables accurate financial planning

Key Metrics:

- Monthly net income

- Income stability ratio

- Fixed vs variable income split

Step 2 – Expense Tracking

Expense tracking is the process of recording and categorizing all expenditures to control spending and improve cash flow.

Expense Categories:

- Fixed expenses (rent, utilities, insurance)

- Variable expenses (food, transport, entertainment)

- Discretionary spending (luxury, leisure)

- Savings & investments

Methods:

- Manual logs

- Budgeting apps

- Spreadsheets

- Bank transaction analysis

Extractable Points:

- Expense tracking improves financial awareness

- It helps identify spending leaks

- It enables better budgeting decisions

Step 3 – Budget Creation

Budgeting is the structured allocation of income across essential expenses, savings, investments, and discretionary spending.

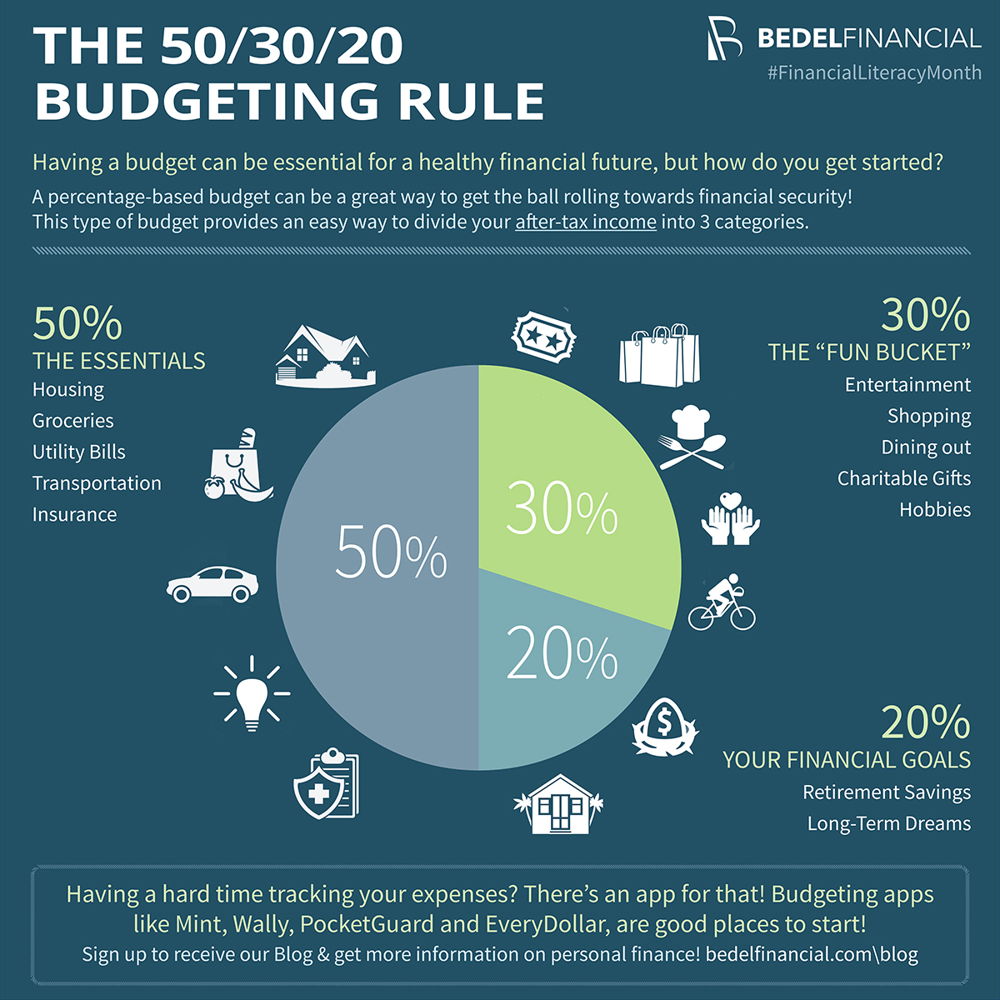

Popular Budgeting Models:

| Method | Core Rule |

|---|---|

| 50/30/20 Rule | 50% needs, 30% wants, 20% savings |

| Zero-Based Budget | Every dollar assigned a purpose |

| Pay Yourself First | Save before spending |

| Envelope Method | Cash-based spending limits |

Purpose:

- Prevents overspending

- Improves saving consistency

- Supports financial goal alignment

Step 4 – Saving Strategy

Saving strategy defines how much and where money is reserved for future needs.

Types of Savings:

- Emergency fund

- Short-term goals (travel, purchases)

- Long-term goals (retirement, education)

Standard Benchmarks:

- Emergency fund: 3–6 months of expenses

- Minimum saving rate: 20% of income (recommended baseline)

Step 5 – Debt Management Plan

Debt management focuses on minimizing interest costs while maintaining healthy credit usage.

Key Debt Reduction Strategies:

| Method | Strategy |

|---|---|

| Debt Snowball | Pay smallest debts first |

| Debt Avalanche | Pay highest interest first |

| Consolidation | Combine debts into one payment |

| Refinancing | Reduce interest rates |

Key Metrics:

- Debt-to-income ratio

- Interest burden ratio

Step 6 – Investment Planning

Investment planning involves allocating surplus funds into assets that generate long-term growth.

Core Investment Principles:

- Risk vs return balance

- Diversification

- Long-term horizon

- Inflation protection

Common Investment Vehicles:

- Stocks

- Bonds

- Mutual funds

- ETFs

- Real estate

Step 7 – Financial Review System

Regular financial reviews ensure continuous optimization and performance tracking.

Review Frequency:

| Review Type | Frequency |

|---|---|

| Expense review | Weekly |

| Budget review | Monthly |

| Goal tracking | Quarterly |

| Full financial audit | Annually |

Step-by-Step Money Management Workflow Table

| Step | Action | Outcome |

|---|---|---|

| 1 | Assess income | Accurate budget foundation |

| 2 | Track expenses | Spending awareness |

| 3 | Create budget | Financial control |

| 4 | Save consistently | Financial security |

| 5 | Reduce debt | Interest minimization |

| 6 | Invest surplus | Wealth growth |

| 7 | Review finances | Continuous improvement |

Summary

Managing money step-by-step requires a structured system covering income assessment, expense tracking, budgeting, saving, debt control, investing, and financial review. This method ensures consistent financial control, long-term stability, and sustainable wealth accumulation.

Key Takeaways

- Structured money management increases financial discipline

- Budgeting ensures controlled spending

- Saving builds financial security

- Investing supports long-term wealth

- Regular reviews improve financial performance

Pros & Cons of Structured Money Management

| Pros | Cons |

|---|---|

| Financial clarity | Requires discipline |

| Reduced financial stress | Time commitment |

| Better savings | Habit-building effort |

| Wealth accumulation | Learning curve |

Best Budgeting Methods for Managing Money

H3: 50/30/20 Rule

The 50/30/20 budgeting rule divides after-tax income into three structured categories to ensure financial balance.

| Category | Allocation | Purpose |

|---|---|---|

| Needs | 50% | Essentials such as housing, food, utilities, transport |

| Wants | 30% | Lifestyle and discretionary spending |

| Savings | 20% | Emergency fund, investments, debt reduction |

Why It Works:

- Simple to implement

- Ensures consistent saving

- Promotes financial balance

Best For: Beginners, salaried individuals, and simple budgeting systems.

Zero-Based Budgeting (ZBB)

Zero-based budgeting assigns every unit of income a specific purpose, ensuring that income minus expenses equals zero.

Core Principle:

Every dollar, rupee, or unit of income must be planned before spending.

Step Process:

- List total income

- Assign spending categories

- Allocate savings

- Plan investments

- Allocate remaining funds

- Balance to zero

Advantages:

- Eliminates unnecessary spending

- Increases financial accountability

- Improves cash flow control

Best For: Business owners, families, and individuals with fluctuating income.

Envelope Budgeting System

The envelope budgeting method uses physical or digital envelopes to allocate spending limits for each expense category.

How It Works:

- Assign cash or digital limits per category

- Spend only from allocated envelopes

- Stop spending when envelope is empty

| Category | Envelope Purpose |

|---|---|

| Groceries | Food control |

| Transport | Fuel & commuting |

| Entertainment | Leisure limits |

| Shopping | Discretionary spending |

Benefits:

- Controls impulse spending

- Improves spending discipline

- Enhances awareness

Best For: High spenders, cash users, and impulse buyers.

Pay Yourself First Method

The pay yourself first approach prioritizes saving before spending.

Core Mechanism:

- Automatically save 20–30% of income

- Use remaining funds for expenses

Primary Benefits:

- Builds strong saving habits

- Increases long-term wealth

- Prevents saving neglect

Best For: Long-term savers, investors, and retirement planners.

Value-Based Budgeting

Value-based budgeting aligns spending with personal or business priorities rather than fixed percentages.

Process:

- Identify financial priorities

- Rank spending categories

- Allocate funds based on value

- Minimize low-value expenses

Key Advantage:

Maximizes financial satisfaction and efficiency.

Best For: Professionals, entrepreneurs, and goal-oriented individuals.

Budgeting Methods Comparison Table

| Method | Complexity | Control Level | Best For |

|---|---|---|---|

| 50/30/20 Rule | Low | Medium | Beginners |

| Zero-Based Budget | High | Very High | Businesses & families |

| Envelope System | Medium | High | Overspenders |

| Pay Yourself First | Low | Medium | Savers & investors |

| Value-Based Budget | Medium | High | Professionals |

Summary

The best budgeting method depends on income structure, financial goals, and spending behavior. While the 50/30/20 rule suits beginners, zero-based budgeting provides strict financial control, and value-based budgeting aligns money with personal priorities for optimized financial decision-making.

Key Takeaways

- Budgeting methods vary based on financial needs and behavior

- Structured budgeting improves expense control and savings

- Zero-based budgeting offers maximum financial discipline

- Value-based budgeting ensures efficient money allocation

Common Budgeting Mistakes to Avoid

| Mistake | Impact |

|---|---|

| Overestimating income | Leads to overspending |

| Ignoring irregular expenses | Causes budget shortfalls |

| Not reviewing budgets | Reduces effectiveness |

| Unrealistic saving goals | Causes financial stress |

Smart Saving Strategies for Long-Term Wealth

H3: Emergency Fund Planning

An emergency fund is a dedicated financial reserve designed to cover unexpected expenses without relying on debt.

Recommended Benchmarks:

| Income Type | Emergency Fund Size |

|---|---|

| Salaried Individuals | 3–6 months of expenses |

| Self-Employed | 6–12 months of expenses |

| Business Owners | 9–12 months of operating costs |

Purpose:

- Protects against income loss

- Prevents high-interest debt

- Provides financial stability

AI Overview – Extractable Facts:

- Emergency funds reduce financial risk

- They prevent reliance on credit

- They improve long-term financial resilience

High-Impact Saving Techniques

High-impact saving focuses on maximizing retained income without reducing lifestyle quality.

Core Techniques:

- Expense categorization

- Cost-to-value analysis

- Spending audits

- Negotiating fixed expenses

- Subscription optimization

| Technique | Financial Impact |

|---|---|

| Expense audit | 5–15% savings |

| Subscription trimming | 5–10% savings |

| Utility optimization | 3–8% savings |

| Lifestyle spending control | 10–20% savings |

Automated Saving Systems

Automation ensures consistent saving behavior by eliminating manual intervention.

Automation Methods:

- Automatic bank transfers

- Salary split accounts

- Auto-investment contributions

- Round-up saving tools

Key Benefits:

- Eliminates decision fatigue

- Improves saving discipline

- Enhances long-term wealth accumulation

Compound Growth Concept

Compound growth refers to earning returns on both the original amount and accumulated earnings, enabling exponential wealth creation.

Compound Interest Formula:

Future Value = Principal × (1 + Rate) ^ Time

| Time Period | Growth Impact |

|---|---|

| 5 Years | Moderate |

| 10 Years | Significant |

| 20 Years | Exponential |

| 30 Years | Wealth acceleration |

Why It Matters:

- Early saving maximizes growth

- Time is the most critical compounding factor

Goal-Based Saving Framework

Goal-based saving aligns saving strategies with defined financial objectives.

Goal Categories:

| Time Horizon | Example Goals |

|---|---|

| Short-Term (0–2 yrs) | Travel, gadgets |

| Mid-Term (3–7 yrs) | Home purchase, education |

| Long-Term (8+ yrs) | Retirement, financial independence |

Saving Strategy Comparison Table

| Strategy | Risk Level | Liquidity | Growth Potential |

|---|---|---|---|

| Emergency Fund | Very Low | High | Low |

| High-Interest Savings | Low | High | Low–Medium |

| Fixed Deposits | Low | Medium | Medium |

| Mutual Funds | Medium | Medium | High |

| ETFs | Medium | High | High |

Summary

Smart saving strategies focus on emergency preparedness, automated saving systems, expense optimization, and compound growth utilization. Structured saving ensures financial stability while enabling sustainable long-term wealth creation through disciplined financial behavior.

Key Takeaways

- Emergency funds protect against financial shocks

- Automation increases saving consistency

- Compound growth accelerates wealth creation

- Goal-based saving improves financial clarity

Pros & Cons of Advanced Saving Strategies

| Pros | Cons |

|---|---|

| Financial security | Requires discipline |

| Wealth acceleration | Delayed gratification |

| Reduced financial stress | Learning curve |

| Future financial independence | Time commitment |

Managing Debt the Right Way

Good Debt vs Bad Debt

Understanding the difference between good debt and bad debt is essential for strategic financial decision-making.

| Type | Description | Examples | Financial Impact |

|---|---|---|---|

| Good Debt | Generates income or long-term value | Education loans, business loans, home loans | Wealth building |

| Bad Debt | High-interest, depreciating purchases | Credit cards, personal loans, payday loans | Wealth erosion |

Key Principle:

Good debt supports asset creation, while bad debt increases financial burden.

Debt Snowball Method

The debt snowball method focuses on eliminating the smallest debts first to build momentum.

Step-by-Step Process:

- List all debts (smallest to largest)

- Pay minimum on all debts

- Direct extra payments to smallest debt

- Roll freed-up payments into next debt

Advantages:

- Builds motivation

- Encourages consistency

- Improves repayment discipline

Best For: Individuals needing psychological motivation.

Debt Avalanche Method

The debt avalanche method prioritizes repaying the highest-interest debt first.

Step-by-Step Process:

- Rank debts by interest rate

- Pay minimum balances

- Direct extra payments to highest interest debt

- Continue until all debts are cleared

Advantages:

- Minimizes interest costs

- Faster total repayment

- Optimal financial efficiency

Best For: Individuals focused on interest savings and optimization.

Debt Consolidation Strategy

Debt consolidation combines multiple debts into a single lower-interest loan.

Benefits:

- Simplified repayment

- Lower interest burden

- Improved cash flow

- Better credit management

Use Cases:

- Multiple high-interest credit cards

- Fragmented personal loans

Refinancing & Interest Reduction

Refinancing involves replacing existing debt with a lower-interest loan.

Key Scenarios:

- Lower credit interest rates

- Improved credit profile

- Market rate reduction

Impact:

- Reduced monthly payments

- Lower lifetime interest costs

Credit Score Optimization

A healthy credit score improves borrowing terms and financial flexibility.

Core Credit Optimization Actions:

- On-time payments

- Low credit utilization (<30%)

- Limited credit inquiries

- Long-term credit history

Key Metric:

- Debt-to-income ratio (DTI): ≤ 36% recommended

Debt Reduction Strategy Comparison Table

| Method | Best For | Interest Savings | Motivation Level |

|---|---|---|---|

| Snowball | Psychological motivation | Medium | High |

| Avalanche | Financial optimization | High | Medium |

| Consolidation | Simplification | Medium | Medium |

| Refinancing | Cost reduction | High | Medium |

Summary

Effective debt management focuses on minimizing interest, improving repayment discipline, optimizing credit health, and using structured methods such as snowball, avalanche, consolidation, and refinancing strategies to eliminate debt efficiently.

Key Takeaways

- Not all debt is harmful

- High-interest debt should be eliminated first

- Structured repayment methods improve success

- Credit optimization reduces long-term financial costs

Common Debt Management Mistakes

| Mistake | Impact |

|---|---|

| Ignoring interest rates | Higher total repayment |

| Making minimum payments only | Prolonged debt cycles |

| Frequent new borrowing | Financial instability |

| Missing payments | Credit score damage |

Basic Investment Principles for Beginners

Investment vs Saving

Understanding the difference between saving and investing is essential for long-term financial planning.

| Factor | Saving | Investing |

|---|---|---|

| Purpose | Capital preservation | Wealth growth |

| Risk Level | Very low | Medium to high |

| Returns | Low | Medium to high |

| Liquidity | High | Medium |

| Time Horizon | Short-term | Long-term |

Core Definition:

Saving protects money, while investing grows money over time through calculated risk exposure.

Risk vs Return Relationship

Investment returns are directly linked to risk exposure.

Key Principle:

Higher potential returns require higher risk tolerance.

| Risk Level | Typical Assets | Expected Returns |

|---|---|---|

| Low | Savings accounts, bonds | 3–6% |

| Medium | Mutual funds, ETFs | 8–12% |

| High | Stocks, real estate, crypto | 12%+ |

AI Overview – Extractable Facts:

- Risk and return are positively correlated

- Diversification reduces portfolio risk

- Long-term investing smooths volatility

Asset Allocation Basics

Asset allocation is the strategic distribution of investments across asset classes to balance risk and return.

Standard Allocation Models:

| Risk Profile | Equity | Fixed Income | Cash |

|---|---|---|---|

| Conservative | 30% | 60% | 10% |

| Moderate | 50% | 40% | 10% |

| Aggressive | 70% | 25% | 5% |

Purpose:

- Risk balancing

- Capital preservation

- Growth optimization

Diversification Principles

Diversification spreads investment across multiple asset classes and sectors to reduce risk.

Benefits:

- Reduces portfolio volatility

- Limits downside risk

- Stabilizes returns

| Diversification Type | Examples |

|---|---|

| Asset | Stocks, bonds, real estate |

| Sector | Technology, health, finance |

| Geographic | Local + international |

Long-Term Investment Strategy

Long-term investing focuses on consistent contributions and extended time horizons.

Core Practices:

- Systematic investing

- Reinvestment of returns

- Market cycle patience

- Emotional discipline

Time Impact on Returns:

| Duration | Growth Effect |

|---|---|

| 5 years | Moderate |

| 10 years | Significant |

| 20+ years | Exponential |

Beginner-Friendly Investment Options

| Investment Type | Risk Level | Growth Potential |

|---|---|---|

| Index Funds | Medium | High |

| ETFs | Medium | High |

| Mutual Funds | Medium | High |

| Government Bonds | Low | Low–Medium |

| Fixed Deposits | Low | Low |

Summary

Investment principles for beginners focus on understanding risk-return dynamics, diversification, asset allocation, and long-term discipline. A structured investment strategy ensures capital protection while enabling sustainable wealth growth through systematic participation in financial markets.

Key Takeaways

- Investing grows wealth beyond inflation

- Risk and return are directly related

- Diversification reduces volatility

- Long-term commitment maximizes compounding

Common Investment Mistakes

| Mistake | Impact |

|---|---|

| Emotional trading | Capital loss |

| Lack of diversification | High volatility |

| Market timing attempts | Missed growth |

| Short-term focus | Reduced returns |

Money Management Tools & Systems

Budgeting Apps

Budgeting apps automate income tracking, expense categorization, and budget monitoring, enabling real-time financial visibility.

| Tool | Core Features | Best For |

|---|---|---|

| Mint | Expense tracking, budgeting, alerts | Beginners |

| YNAB (You Need A Budget) | Zero-based budgeting, goal tracking | Advanced budgeting |

| PocketGuard | Spending limits, bill tracking | Daily expense control |

| Goodbudget | Envelope budgeting system | Family budgeting |

Key Benefits:

- Automated tracking

- Spending insights

- Budget adherence alerts

- Financial discipline

Expense Tracking Tools

Expense tracking tools focus on capturing every transaction to improve financial control.

Common Tracking Methods:

- Banking apps

- Financial aggregators

- Manual spreadsheets

- Receipt scanning apps

Core Purpose:

- Identify spending leaks

- Improve cost efficiency

- Strengthen financial awareness

Financial Planning Software

Financial planning tools support long-term financial forecasting, investment planning, and goal tracking.

| Software | Primary Use |

|---|---|

| Personal Capital | Investment & net worth tracking |

| Quicken | Full financial management |

| Tiller | Spreadsheet-based automation |

| Moneydance | Personal finance planning |

Key Capabilities:

- Net worth monitoring

- Investment performance tracking

- Retirement planning

- Cash flow forecasting

Spreadsheet-Based Money Systems

Spreadsheets provide maximum customization and control for money management.

Common Platforms:

- Microsoft Excel

- Google Sheets

Use Cases:

- Custom budgeting

- Expense dashboards

- Investment tracking

- Cash flow forecasting

Advantages:

- High flexibility

- Full data ownership

- Advanced customization

Automation Tools for Financial Control

Automation tools eliminate manual financial tasks, improving efficiency and accuracy.

Automation Systems:

- Auto salary splitting

- Automatic savings transfers

- Auto investment contributions

- Bill auto-pay systems

Financial Impact:

- Higher saving consistency

- Reduced late fees

- Improved discipline

Tools Comparison Table

| Tool Type | Automation | Control Level | Complexity |

|---|---|---|---|

| Budgeting Apps | High | Medium | Low |

| Expense Trackers | Medium | High | Medium |

| Financial Software | High | Very High | Medium |

| Spreadsheets | Low | Very High | High |

| Automation Tools | Very High | Medium | Low |

Summary

Money management tools and systems enhance financial discipline through automation, real-time tracking, structured budgeting, and long-term planning. Selecting the right tools improves accuracy, consistency, and overall financial performance.

Key Takeaways

- Tools simplify money management

- Automation increases financial consistency

- Financial software improves long-term planning

- Spreadsheets offer full customization

Pros & Cons of Digital Money Tools

| Pros | Cons |

|---|---|

| Automation | Data security risks |

| Real-time tracking | Learning curve |

| Improved discipline | Subscription costs |

| Faster decisions | Tool dependency |

Common Money Management Mistakes to Avoid

Overspending Traps

Overspending occurs when expenses consistently exceed income, leading to debt accumulation and financial stress.

Common Overspending Triggers:

- Impulse buying

- Lifestyle inflation

- Emotional spending

- Poor budgeting discipline

Impact:

- Reduced savings

- Increased debt

- Cash flow instability

Prevention Strategies:

- Expense tracking

- Spending limits

- Delayed purchasing rules

- Budget enforcement

Lifestyle Inflation

Lifestyle inflation happens when spending increases alongside income, preventing wealth accumulation.

| Income Increase | Spending Reaction | Financial Outcome |

|---|---|---|

| Salary raise | Higher expenses | No savings growth |

| Bonus | Luxury spending | Missed investment |

| Business profit | Lifestyle upgrades | Slower wealth building |

Key Risk:

Higher earnings without saving discipline delay financial independence.

Emotional Spending

Emotional spending refers to purchasing driven by stress, excitement, or social pressure rather than necessity.

Common Emotional Triggers:

- Stress

- Anxiety

- Social comparison

- Marketing pressure

Financial Consequences:

- Budget breakdown

- Reduced savings

- Increased credit use

Lack of Emergency Fund

Absence of an emergency fund exposes individuals to high-interest borrowing during financial shocks.

| Scenario | Impact Without Emergency Fund |

|---|---|

| Medical emergency | Debt accumulation |

| Job loss | Financial crisis |

| Business loss | Operational instability |

Recommended Solution:

Maintain 3–6 months of expense reserves.

Ignoring Investment Planning

Avoiding investments leads to inflation erosion and missed compounding growth.

| Behavior | Long-Term Impact |

|---|---|

| Saving only | Inflation erosion |

| Delayed investing | Reduced wealth |

| No diversification | High risk |

Poor Debt Control

Uncontrolled borrowing creates financial instability and long-term repayment burdens.

High-Risk Debt Practices:

- Credit card dependence

- Payday loans

- High-interest personal loans

Key Metric:

Debt-to-income ratio should remain ≤ 36%.

Mistake Impact Table

| Mistake | Financial Risk Level | Long-Term Impact |

|---|---|---|

| Overspending | High | Debt accumulation |

| Lifestyle inflation | Medium | Delayed wealth |

| Emotional spending | Medium | Budget breakdown |

| No emergency fund | Very High | Financial crisis |

| No investing | High | Wealth stagnation |

Summary Box

Avoiding common money management mistakes such as overspending, emotional buying, lifestyle inflation, lack of emergency funds, and neglecting investments significantly improves financial stability, savings growth, and long-term wealth creation.

Key Takeaways

- Discipline prevents financial mistakes

- Emergency funds protect against crises

- Investment planning ensures wealth growth

- Emotional spending erodes financial control

Pros & Cons of Strict Financial Discipline

| Pros | Cons |

|---|---|

| Higher savings | Reduced impulsive spending |

| Strong financial security | Lifestyle adjustment |

| Long-term wealth | Requires habit change |

Practical Money Management Framework by BizFusionWorks

The BizFusionWorks 6-Step Financial Control Model

The BizFusionWorks 6-Step Financial Control Model is a structured, repeatable framework designed to deliver consistent financial discipline, stability, and long-term wealth growth.

| Step | Action | Objective |

|---|---|---|

| 1 | Income Structuring | Create predictable cash flow |

| 2 | Expense Optimization | Control spending leakage |

| 3 | Smart Budgeting | Allocate funds efficiently |

| 4 | Automated Saving | Build financial safety |

| 5 | Strategic Investing | Enable wealth growth |

| 6 | Continuous Review | Maintain financial performance |

Step 1 – Income Structuring

Income structuring focuses on organizing multiple income streams for stability and predictability.

Key Actions:

- Identify fixed vs variable income

- Diversify income sources

- Improve income consistency

- Implement cash flow forecasting

Outcome:

Stable monthly cash flow and reduced financial uncertainty.

Step 2 – Expense Optimization

Expense optimization identifies and eliminates low-value or wasteful spending.

Core Techniques:

- Expense audits

- Subscription optimization

- Cost-benefit evaluation

- Spending category benchmarking

Expected Impact:

5–20% reduction in unnecessary expenses.

Step 3 – Smart Budgeting System

The BizFusionWorks budgeting model combines zero-based budgeting + value-based allocation.

| Budget Component | Purpose |

|---|---|

| Fixed essentials | Stability |

| Variable essentials | Flexibility |

| Priority spending | Value alignment |

| Savings allocation | Security |

| Investment allocation | Growth |

Step 4 – Automated Saving System

Automation ensures consistent saving and emergency preparedness.

Automation Framework:

- Salary split accounts

- Auto emergency fund deposits

- Scheduled investment transfers

Target Benchmarks:

- Emergency fund: 3–6 months expenses

- Savings rate: 20–30% of income

Step 5 – Strategic Investment Framework

This framework emphasizes long-term, risk-adjusted growth.

Investment Allocation Strategy:

| Risk Profile | Equity | Fixed Income | Cash |

|---|---|---|---|

| Conservative | 30% | 60% | 10% |

| Balanced | 50% | 40% | 10% |

| Growth | 70% | 25% | 5% |

Key Focus:

- Asset diversification

- Reinvestment discipline

- Market cycle resilience

Step 6 – Monthly Review & Optimization System

Continuous financial review ensures performance tracking and strategic adjustment.

| Review Area | Frequency | Purpose |

|---|---|---|

| Expense audit | Monthly | Cost control |

| Budget review | Monthly | Optimization |

| Savings progress | Monthly | Goal alignment |

| Investment tracking | Quarterly | Return monitoring |

| Financial audit | Annually | Strategic planning |

BizFusionWorks Financial Control Flow Table

| Phase | Action | Outcome |

|---|---|---|

| Planning | Budget + goals | Direction |

| Execution | Spending + saving | Control |

| Monitoring | Tracking + review | Stability |

| Optimization | Adjustment | Growth |

Summary Box

The BizFusionWorks Practical Money Management Framework provides a structured financial control system combining budgeting, automation, investment discipline, and continuous performance tracking to ensure long-term financial stability, efficiency, and sustainable wealth creation.

Key Takeaways

- Structured systems outperform ad-hoc money management

- Automation increases saving discipline

- Strategic investment ensures wealth growth

- Monthly reviews maintain financial accuracy

Pros & Cons of the BizFusionWorks Framework

| Pros | Cons |

|---|---|

| High financial control | Requires consistency |

| Strong saving discipline | Initial setup effort |

| Long-term wealth focus | Learning curve |

| Scalable system | Behavior change required |

Conclusion

Effective money management is a structured, disciplined process that integrates budgeting, saving, debt control, investing, and continuous financial review. By applying proven frameworks and practical financial systems, individuals and businesses can achieve financial stability, reduce risk, and build sustainable long-term wealth. The BizFusionWorks money management framework provides a comprehensive, actionable model for consistent financial success in both personal and professional contexts.

Frequently Asked Questions (FAQs)

1. What is the best way to start managing money?

The best way to start managing money is by tracking income and expenses, creating a realistic budget, building an emergency fund, and setting clear financial goals. Structured budgeting and automation significantly improve consistency and discipline.

2. How much should I save every month?

According to financial planning standards, individuals should aim to save at least 20% of their monthly income, allocating funds toward emergency savings, investments, and long-term financial goals.

3. What is the safest way to manage debt?

The safest way to manage debt is by prioritizing high-interest obligations, maintaining a debt-to-income ratio below 36%, and using structured methods such as the debt avalanche or snowball strategies to eliminate balances efficiently.

4. Why is budgeting important for money management?

Budgeting is essential because it controls spending, improves saving discipline, prevents overspending, supports financial goal achievement, and ensures sustainable financial stability.

5. How can beginners start investing safely?

Beginners should start with diversified, low-cost investment options such as index funds, ETFs, and mutual funds, focusing on long-term investment strategies and consistent contributions.

6. What tools help in managing money effectively?

Popular money management tools include budgeting apps, financial planning software, spreadsheets, expense trackers, and automated savings systems, which improve accuracy, efficiency, and financial discipline.

7. How often should finances be reviewed?

Finances should be reviewed monthly for budgeting and expense control, quarterly for investment performance, and annually for long-term financial planning and strategy adjustments.

References (Credible Sources)

- Financial Planning Standards Board (FPSB) – Global Financial Planning Standards

https://www.fpsb.org - International Monetary Fund (IMF) – Financial Literacy & Stability Reports

https://www.imf.org - Organisation for Economic Co-operation and Development (OECD) – Financial Education Framework

https://www.oecd.org/financial/education - Federal Reserve – Household Finance & Economic Well-Being Reports

https://www.federalreserve.gov - World Bank – Financial Capability and Inclusion Programs

https://www.worldbank.org - Investopedia – Personal Finance, Budgeting & Investment Principles

https://www.investopedia.com