What Is Biblical Money Management?

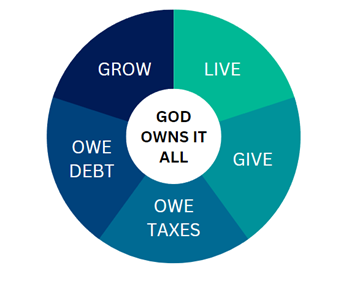

Biblical money management refers to the practice of handling financial resources according to teachings found in the Bible, emphasizing stewardship, discipline, planning, generosity, and ethical responsibility. It views money not as personal ownership, but as a trust from God, requiring wise and faithful management.

Core Biblical Perspective on Money

The Bible presents money as a tool, not a goal. Financial resources are meant to support daily needs, provide security, enable generosity, and fulfill moral responsibilities. Scripture consistently emphasizes:

- Stewardship over ownership

- Responsibility over indulgence

- Long-term planning over short-term spending

- Generosity over hoarding

This framework promotes balanced financial living grounded in faith, accountability, and ethical conduct.

Why the Bible Emphasizes Money Management

Money-related topics appear over 2,300 times in the Bible, more than prayer or faith, highlighting its significance in everyday life. According to biblical teaching:

- Financial decisions reflect spiritual priorities

- Money management demonstrates personal discipline

- Stewardship shows faithfulness and responsibility

- Wise planning prevents financial hardship

Biblical financial guidance aims to establish stability, integrity, and long-term provision, rather than wealth accumulation.

Key Biblical Concepts Behind Money Management

| Concept | Meaning | Financial Application |

|---|---|---|

| Stewardship | Managing what belongs to God | Responsible spending and saving |

| Provision | God supplies needs | Avoid anxiety-driven decisions |

| Planning | Preparing for future needs | Budgeting and saving |

| Generosity | Supporting others | Tithing and charitable giving |

| Contentment | Satisfaction with enough | Avoiding greed and excess |

Biblical Money Management vs Modern Financial Systems

| Biblical Teaching | Modern Financial Equivalent |

|---|---|

| Stewardship | Asset management |

| Budgeting | Financial planning |

| Debt avoidance | Low debt-to-income ratio |

| Saving | Emergency funds & retirement planning |

| Generosity | Charitable giving |

This alignment shows that biblical principles remain financially relevant in modern economic systems.

How Biblical Money Management Works in Daily Life

- Establishing a structured budget

- Saving consistently

- Avoiding unnecessary debt

- Practicing generosity

- Making ethical financial choices

- Planning for long-term needs

QUICK FACTS

- Biblical money management focuses on stewardship, planning, discipline, and generosity.

- The Bible views money as a trust from God, not personal ownership.

- Financial decisions are considered spiritual responsibilities.

- Scripture emphasizes saving, debt avoidance, and ethical earning.

Summary

Understanding Biblical Money Management:

Biblical money management is a faith-based financial framework built on stewardship, ethical earning, disciplined budgeting, saving, generosity, and contentment. It promotes financial stability, moral responsibility, and long-term provision.

Key Takeaways

- Money is a responsibility, not an entitlement

- Financial discipline reflects spiritual maturity

- Planning and saving are biblical practices

- Generosity is a core financial principle

- Understanding Biblical Money Management

- Managing Money Effectively: Complete Guide to Financial Control | BizFusionWorksRead the blog:

Common Misconceptions

- Wealth is sinful → ❌ The Bible warns against love of money, not money itself

- Budgeting shows lack of faith → ❌ Planning is repeatedly encouraged

- Giving causes financial loss → ❌ Biblical teaching emphasizes long-term provision

- God Owns Everything — Stewardship Over Ownership

Biblical Explanation

The foundational principle of biblical money management is stewardship, which teaches that God is the ultimate owner of all resources, and humans are entrusted as managers rather than absolute owners. This perspective shifts financial behavior from entitlement to responsibility.

Biblical stewardship emphasizes:

Accountability in financial decisions

Responsible use of resources

Long-term planning

Ethical financial conduct

Stewardship requires individuals to manage money wisely, faithfully, and purposefully, aligning spending, saving, and giving with biblical values.

Key Bible Verses Supporting Stewardship

Scripture

Core Teaching

Psalm 24:1

God owns everything

Haggai 2:8

Wealth belongs to God

1 Corinthians 4:2

Faithfulness in management

Luke 16:11

Trustworthiness with money

What Stewardship Means in Financial Terms

Stewardship Principle

Practical Financial Meaning

God owns all wealth

Money is a trust, not possession

Humans are stewards

Responsible management

Accountability

Thoughtful spending and saving

Faithfulness

Long-term financial discipline

Practical Financial Applications of Stewardship

1. Budgeting with Purpose

Spending is guided by necessity, responsibility, and value rather than impulse or excess.

2. Responsible Saving

Saving is viewed as preparing for future needs, emergencies, and family stability.

3. Ethical Earning

Income is earned honestly, fairly, and without exploitation.

4. Generous Giving

Financial resources are shared to support others, charitable causes, and community welfare.

Modern-Day Financial Examples

Financial Decision

Stewardship-Based Action

Income management

Allocate responsibly

Spending choices

Prioritize needs over wants

Debt usage

Avoid unnecessary borrowing

Wealth growth

Use ethically and purposefully

Why Stewardship Improves Financial Stability

Stewardship promotes:

Reduced debt

Increased savings discipline

Controlled spending

Purpose-driven wealth

Long-term financial security

This leads to sustainable financial well-being rather than short-term financial satisfaction.

Extractable Key Facts

Biblical stewardship teaches that God owns all wealth, and humans manage it responsibly.

Stewardship promotes budgeting, saving, generosity, and ethical earning.

Financial accountability is a spiritual responsibility.

Wise stewardship leads to long-term financial stability.

Summary

Principle of Stewardship:

God owns all resources, and individuals are entrusted to manage money wisely, ethically, and responsibly. Stewardship forms the foundation of all biblical financial principles.

Key Takeaways

Money is a responsibility, not ownership

Financial decisions require accountability

Stewardship promotes discipline and planning

Ethical financial management aligns faith with finances - Stewardship Over Ownership

Pros & Cons of Stewardship-Based Money Management

Pros

Promotes financial discipline

Encourages responsible spending

Builds long-term security

Strengthens ethical behavior

Cons

Requires consistent self-control

Demands long-term financial commitment

Common Mistakes & Misconceptions

Confusing ownership with stewardship

Overspending due to entitlement thinking

Ignoring accountability

Neglecting budgeting and planning - Principle 2: Earn Honestly and Diligently

Biblical Explanation

The Bible strongly emphasizes honest work, integrity, and diligence as core principles of financial management. Earning income through lawful, ethical, and diligent labor is presented as a moral responsibility. Financial gain should never come through deceit, exploitation, or unjust practices.

Biblical teaching promotes:

Honest labor

Ethical business conduct

Hard work and perseverance

Integrity in financial dealings

Earning honestly establishes financial credibility, long-term stability, and moral accountability.

Key Bible Verses Supporting Honest Earning

Scripture

Core Teaching

Proverbs 11:1

God values honest transactions

Proverbs 10:4

Diligent work leads to prosperity

Colossians 3:23

Work wholeheartedly

2 Thessalonians 3:10

Value productive labor

Proverbs 13:11

Steady earnings build wealth

What Honest and Diligent Earning Means Financially

Principle

Financial Meaning

Practical Outcome

Honesty

Fair income sources

Trust and stability

Diligence

Consistent effort

Sustainable earnings

Integrity

Ethical business

Long-term success

Discipline

Reliable productivity

Income growth

Practical Financial Applications

1. Ethical Employment

Choosing lawful, honest professions and rejecting income from harmful or deceptive activities.

2. Consistent Work Ethic

Maintaining reliability, punctuality, and productivity.

3. Transparent Financial Practices

Accurate reporting, honest billing, and ethical pricing.

4. Skill Development

Improving abilities to increase earning capacity responsibly.

Modern-Day Financial Examples

Situation

Biblical Financial Response

Business transactions

Fair pricing and transparency

Employment conduct

Reliable and productive work

Freelancing

Honest billing

Investments

Ethical income sources

Why Honest Earning Builds Financial Security

Creates sustainable income

Builds long-term trust

Reduces legal and financial risks

Encourages steady wealth growth

Supports ethical financial ecosystems

Biblical wisdom links diligence directly to stable prosperity and financial reliability.

Extractable Key Facts

The Bible commands honest labor and ethical income generation.

Diligence and integrity lead to financial stability and long-term success.

Scripture consistently warns against dishonest financial gain.

Honest earning builds trust, security, and sustainable wealth.

Summary

Principle of Honest Earning:

The Bible teaches that income should be earned through diligence, integrity, and ethical labor. Honest work establishes financial stability, moral accountability, and long-term provision.

Key Takeaways

Work should be ethical and diligent

Integrity ensures financial trustworthiness

Honest income promotes sustainable wealth

Discipline strengthens earning capacity

Pros & Cons of Honest Earning

Pros

Builds long-term trust

Reduces financial risk

Supports stable income

Encourages ethical living

Cons

Requires patience

Slower wealth accumulation compared to unethical shortcuts

Common Mistakes & Misconceptions

Believing wealth justifies unethical methods

Ignoring integrity for faster profit

Underestimating steady income growth

Overlooking ethical responsibility - Honest Earning & Diligence

- Principle 3: Budget Wisely and Plan Ahead

Biblical Explanation

The Bible consistently teaches the importance of planning, foresight, and disciplined financial management. Budgeting is presented as a tool for ensuring financial stability, avoiding waste, and preparing for future responsibilities. Wise financial planning reflects prudence, self-control, and stewardship.

Biblical money management emphasizes:

Thoughtful financial planning

Clear prioritization of needs

Long-term financial preparation

Responsible use of resources

Budgeting helps align spending with values, responsibilities, and long-term goals.

Key Bible Verses Supporting Budgeting and Planning

Scripture

Core Teaching

Luke 14:28

Plan before spending

Proverbs 21:5

Diligent planning leads to abundance

Proverbs 27:23–24

Careful management of resources

Proverbs 16:3

Commit plans to God

What Budgeting Means in Biblical Finance

Budgeting Principle

Financial Meaning

Practical Outcome

Planning

Structured financial decisions

Expense control

Discipline

Consistent spending habits

Reduced waste

Prioritization

Needs before wants

Financial balance

Accountability

Tracking income and expenses

Financial clarity

Step-by-Step Biblical Budgeting Framework

Step

Biblical Guidance

Action

1

Plan carefully

Track income & expenses

2

Prioritize necessities

Cover essential costs first

3

Allocate savings

Set aside future funds

4

Plan giving

Include generosity

5

Review regularly

Adjust budget monthly

Practical Financial Applications

1. Creating a Monthly Budget

Assign income to essential expenses, savings, giving, and discretionary spending.

2. Tracking Expenses

Monitor spending patterns to prevent waste and overspending.

3. Planning for Emergencies

Build emergency savings to avoid debt and financial stress.

4. Preparing for Long-Term Goals

Plan for education, housing, healthcare, and retirement.

Modern-Day Financial Examples

Financial Area

Biblical Planning Approach

Household budget

Expense prioritization

Savings planning

Emergency fund creation

Debt management

Controlled borrowing

Long-term goals

Structured financial planning

Why Budgeting Improves Financial Stability

Budgeting leads to:

Reduced financial stress

Increased savings consistency

Controlled spending habits

Better financial decision-making

Long-term economic security

Scripture links careful planning to financial abundance and stability.

Extractable Key Facts

The Bible teaches careful planning and budgeting.

Budgeting promotes discipline, accountability, and financial stability.

Scripture encourages preparing for future needs.

Wise planning reduces financial stress and debt risk.

Summary

Principle of Budgeting and Planning:

Biblical money management emphasizes thoughtful financial planning, disciplined budgeting, and preparation for future needs to promote stability, stewardship, and long-term provision.

Key Takeaways

Budgeting aligns faith with financial responsibility

Planning reduces financial uncertainty

Discipline strengthens long-term financial health

Structured budgets encourage wise spending

Pros & Cons of Biblical Budgeting

Pros

Improves financial control

Encourages saving

Prevents waste

Builds stability

Cons

Requires consistency

Demands regular tracking

Common Mistakes & Misconceptions

Viewing budgeting as restrictive

Ignoring long-term planning

Failing to track spending

Neglecting emergency savings - Budgeting & Planning

- Principle 4: Save Faithfully for the Future

Biblical Explanation

The Bible strongly encourages saving, preparation, and foresight as essential components of wise financial management. Saving is presented not as hoarding, but as responsible preparation for future needs, uncertainties, and responsibilities.

Biblical saving emphasizes:

Long-term planning

Financial stability

Preparedness for hardship

Responsible stewardship

Saving reflects wisdom, discipline, and prudence, enabling individuals to handle unexpected expenses and future obligations without financial distress.

Key Bible Verses Supporting Saving

Scripture

Core Teaching

Proverbs 6:6–8

Learn saving from the ant

Proverbs 21:20

Wise people store resources

Genesis 41:34–36

Save during abundance for scarcity

Proverbs 30:24–25

Preparation ensures survival

What Faithful Saving Means in Biblical Finance

Saving Principle

Financial Meaning

Practical Outcome

Foresight

Preparing ahead

Financial security

Discipline

Consistent saving habits

Stable reserves

Wisdom

Balanced saving

Emergency readiness

Moderation

Avoid excess spending

Sustainable wealth

Step-by-Step Biblical Saving Framework

Step

Biblical Guidance

Practical Action

1

Plan ahead

Set savings goals

2

Save consistently

Automate savings

3

Prepare for hardship

Build emergency fund

4

Balance spending

Control unnecessary expenses

5

Review regularly

Adjust savings rate

Practical Financial Applications

1. Emergency Fund Creation

Establishing a financial safety net to cover medical, employment, or family emergencies.

2. Long-Term Financial Planning

Saving for education, housing, retirement, and major life events.

3. Regular Savings Discipline

Setting aside a fixed percentage of income consistently.

4. Avoiding Impulsive Spending

Prioritizing future needs over immediate wants.

Modern-Day Financial Examples

Financial Area

Biblical Saving Approach

Emergency fund

3–6 months expenses

Retirement

Long-term savings plans

Education

Planned savings accounts

Major purchases

Gradual saving instead of debt

Why Faithful Saving Improves Financial Stability

Faithful saving:

Reduces reliance on debt

Provides financial security

Enables crisis preparedness

Promotes long-term independence

Builds financial resilience

Scripture consistently connects preparation with wisdom and stability.

Extractable Key Facts

The Bible teaches saving as wise preparation, not hoarding.

Faithful saving ensures financial stability and emergency readiness.

Scripture encourages consistent and disciplined saving habits.

Preparation reduces future financial stress and dependency.

Summary

Principle of Faithful Saving:

Biblical money management encourages disciplined and consistent saving to prepare for future needs, emergencies, and responsibilities, promoting financial security and wise stewardship.

Key Takeaways

Saving reflects wisdom and foresight

Preparation prevents financial crisis

Discipline builds long-term stability

Balanced saving supports future goals

Pros & Cons of Biblical Saving

Pros

Builds financial security

Reduces debt dependency

Enhances preparedness

Encourages discipline

Cons

Requires patience

Limits short-term spending

Common Mistakes & Misconceptions

Confusing saving with greed

Delaying savings until later

Saving without financial goals

Ignoring emergency preparedness

- Principle 5: Avoid Debt and Live Within Your Means

Biblical Explanation

The Bible consistently warns against excessive debt, emphasizing financial freedom, self-control, and responsible living. Debt is portrayed as a form of financial bondage that can restrict personal freedom, create long-term stress, and compromise stewardship.

Biblical money management promotes:

Living within available resources

Avoiding unnecessary borrowing

Practicing financial discipline

Maintaining independence and stability

Debt avoidance supports financial freedom, peace of mind, and long-term sustainability.

Key Bible Verses Supporting Debt Avoidance

Scripture

Core Teaching

Proverbs 22:7

Debt creates servitude

Romans 13:8

Avoid owing obligations

Proverbs 17:18

Warning against risky financial commitments

Luke 14:28–30

Count the cost before financial decisions

What Living Within Your Means Means Financially

Principle

Financial Meaning

Practical Outcome

Moderation

Controlled spending

Financial balance

Discipline

Budget-based living

Reduced debt risk

Planning

Expense forecasting

Stable finances

Responsibility

Income-based lifestyle

Long-term security

Step-by-Step Biblical Debt-Avoidance Framework

Step

Biblical Guidance

Practical Action

1

Count the cost

Evaluate affordability

2

Live within income

Avoid lifestyle inflation

3

Limit borrowing

Use debt cautiously

4

Prioritize repayment

Reduce existing debt

5

Build savings

Prevent future borrowing

Practical Financial Applications

1. Responsible Spending

Making purchases based on necessity rather than impulse.

2. Controlled Lifestyle Choices

Maintaining expenses below income to ensure savings and stability.

3. Debt Reduction Planning

Systematic repayment of existing financial obligations.

4. Emergency Fund Development

Preventing reliance on credit during financial emergencies.

Modern-Day Financial Examples

Financial Area

Biblical Debt-Avoidance Approach

Credit cards

Limited and responsible use

Loans

Only for essential purposes

Lifestyle upgrades

Income-based decisions

Emergency expenses

Covered through savings

Why Debt Avoidance Improves Financial Stability

Avoiding debt:

Reduces financial stress

Increases savings potential

Enhances financial independence

Protects long-term wealth

Encourages disciplined spending

Scripture links debt freedom to peace, responsibility, and wise stewardship.

Extractable Key Facts

The Bible warns that debt leads to financial bondage.

Living within one’s means promotes financial freedom and stability.

Scripture encourages careful planning before borrowing.

Debt avoidance supports long-term financial security.

Summary

Principle of Debt Avoidance:

Biblical money management teaches disciplined spending, careful planning, and avoiding unnecessary debt to preserve financial freedom, stability, and responsible stewardship.

Key Takeaways

Debt reduces financial freedom

Controlled spending supports long-term security

Planning prevents financial mistakes

Living within means promotes peace and stability

Pros & Cons of Debt-Free Living

Pros

Financial independence

Lower stress

Increased savings

Greater stability

Cons

Slower asset acquisition

Requires disciplined lifestyle choices

Common Mistakes & Misconceptions

Treating debt as normal lifestyle financing

Using credit for unnecessary spending

Ignoring long-term repayment consequences

Failing to build emergency savings - Principle 6: Give Generously and Practice Tithing

Biblical Explanation

The Bible consistently emphasizes generosity and giving as central components of faithful financial stewardship. Giving is presented not merely as charity, but as an act of obedience, gratitude, and worship. Tithing, traditionally understood as giving one-tenth (10%) of income, represents disciplined generosity and trust in divine provision.

Biblical generosity reflects:

Faith in God’s provision

Compassion toward others

Responsibility toward community welfare

Gratitude for blessings received

Generous giving aligns financial behavior with spiritual values and ethical responsibility.

Key Bible Verses Supporting Giving and Tithing

Scripture

Core Teaching

Malachi 3:10

Faithfulness in tithing

Proverbs 11:24–25

Generosity leads to blessing

Luke 6:38

Giving results in abundance

2 Corinthians 9:6–7

Cheerful giving

Acts 20:35

Blessing of generosity

What Giving and Tithing Mean in Biblical Finance

Giving Principle

Financial Meaning

Practical Outcome

Tithing

Giving 10% regularly

Structured generosity

Charity

Helping the needy

Social responsibility

Faith-based giving

Trust in provision

Spiritual growth

Consistency

Regular donations

Sustainable support

Step-by-Step Biblical Giving Framework

Step

Biblical Guidance

Practical Action

1

Give first

Set aside tithe early

2

Give consistently

Maintain regular donations

3

Give cheerfully

Avoid obligation-based giving

4

Support need

Help vulnerable groups

5

Review giving

Adjust based on income

Practical Financial Applications

1. Practicing Tithing

Setting aside 10% of income regularly for faith-based contributions.

2. Charitable Donations

Supporting community development, relief programs, and humanitarian efforts.

3. Supporting Family and Community Needs

Assisting dependents and vulnerable individuals.

4. Planned Generosity

Including giving within personal financial budgets.

Modern-Day Financial Examples

Financial Area

Biblical Giving Application

Monthly income

Allocate 10% tithe

Community support

Regular charity contributions

Emergency relief

Financial assistance

Social welfare

Support for education and health

Why Generosity Improves Financial and Social Stability

Generous giving:

Strengthens social bonds

Reduces inequality

Promotes empathy

Encourages ethical financial behavior

Builds communal resilience

Biblical wisdom associates generosity with blessing, spiritual fulfillment, and social harmony.

Extractable Key Facts

The Bible teaches generosity and tithing as essential financial practices.

Tithing traditionally involves giving 10% of income regularly.

Scripture links generous giving with spiritual and material blessings.

Giving supports community welfare and social stability.

Summary

Principle of Generosity and Tithing:

Biblical money management encourages disciplined generosity, faithful tithing, and compassionate giving to promote spiritual growth, community support, and ethical financial stewardship.

Key Takeaways

Giving reflects faith and gratitude

Tithing encourages financial discipline

Generosity supports social responsibility

Planned giving ensures sustainable contributions

Pros & Cons of Generous Giving

Pros

Strengthens community

Encourages compassion

Builds spiritual fulfillment

Supports ethical living

Cons

Requires disciplined budgeting

Demands consistent commitment

Common Mistakes & Misconceptions

Viewing giving as optional

Treating tithing as financial loss

Inconsistent donation habits

Giving without financial planning - Principle 7: Practice Contentment and Financial Discipline

Biblical Explanation

The Bible strongly emphasizes contentment, self-control, and financial discipline as essential virtues in money management. Contentment teaches satisfaction with what one has, while discipline ensures responsible financial behavior. Together, they protect individuals from greed, materialism, impulsive spending, and financial instability.

Biblical contentment encourages:

Satisfaction over excess

Gratitude over greed

Discipline over impulse

Simplicity over extravagance

This principle promotes peaceful, balanced, and sustainable financial living.

Key Bible Verses Supporting Contentment and Discipline

Scripture

Core Teaching

Hebrews 13:5

Be content with what you have

1 Timothy 6:6–8

Contentment brings great gain

Proverbs 25:28

Self-control prevents collapse

Philippians 4:11–12

Learn contentment in all situations

Luke 12:15

Guard against greed

What Contentment Means in Biblical Finance

Principle

Financial Meaning

Practical Outcome

Contentment

Satisfaction with provision

Reduced spending pressure

Discipline

Controlled financial behavior

Stable finances

Gratitude

Appreciation of resources

Wise spending

Simplicity

Minimalist lifestyle

Financial clarity

Step-by-Step Biblical Discipline Framework

Step

Biblical Guidance

Practical Action

1

Practice gratitude

Focus on needs met

2

Control desires

Limit impulse purchases

3

Set spending limits

Follow a budget

4

Delay gratification

Avoid unnecessary upgrades

5

Reflect regularly

Review spending habits

Practical Financial Applications

1. Avoiding Lifestyle Inflation

Maintaining consistent living standards despite income increases.

2. Controlling Impulse Spending

Evaluating necessity before purchasing.

3. Practicing Gratitude-Based Budgeting

Spending aligned with appreciation rather than comparison.

4. Long-Term Financial Stability

Preventing debt accumulation through disciplined choices.

Modern-Day Financial Examples

Financial Area

Biblical Contentment Approach

Lifestyle choices

Income-based living

Consumer purchases

Needs before wants

Social comparison

Gratitude-based spending

Income growth

Savings over indulgence

Why Contentment Improves Financial Stability

Contentment and discipline:

Reduce unnecessary expenses

Prevent debt accumulation

Promote saving consistency

Increase financial peace

Encourage sustainable living

Scripture links contentment directly to emotional well-being and financial security.

Extractable Key Facts

The Bible teaches contentment and self-discipline as core financial virtues.

Contentment reduces greed, impulse spending, and debt risk.

Financial discipline promotes long-term stability and peace.

Scripture warns against materialism and excessive desire.

Summary

Principle of Contentment and Discipline:

Biblical money management emphasizes satisfaction with provision and disciplined financial habits to promote peace, stability, and responsible stewardship.

Key Takeaways

Contentment reduces financial pressure

Discipline strengthens money control

Gratitude promotes wise spending

Simplicity supports long-term stability

Pros & Cons of Contentment-Based Financial Living

Pros

Lower stress

Greater savings

Reduced debt

Improved financial clarity

Cons

Requires self-control

Resists consumer culture pressures

Common Mistakes & Misconceptions

Confusing contentment with lack of ambition

Using spending for emotional comfort

Chasing social comparison

Ignoring disciplined financial habits

How to Apply Biblical Money Principles in Daily Life

Practical Framework for Faith-Based Financial Living

Applying biblical money principles requires intentional daily habits, disciplined financial planning, and consistent spiritual alignment. These principles translate into real-world financial decisions that promote stability, responsibility, and long-term well-being.

Biblical financial application focuses on:

Structured budgeting

Ethical earning

Disciplined saving

Responsible spending

Debt avoidance

Planned generosity

Contentment-based living

Step-by-Step Biblical Money Management System

Step

Biblical Principle

Practical Action

1

Stewardship

Create a purpose-driven budget

2

Honest earning

Maintain ethical income sources

3

Planning

Track income and expenses

4

Saving

Build emergency and long-term funds

5

Debt avoidance

Limit borrowing

6

Giving

Practice regular generosity

7

Contentment

Control lifestyle inflation

Daily Financial Habits Based on Biblical Teachings

1. Intentional Budgeting

Track income, allocate spending limits, and plan financial priorities monthly.

2. Expense Awareness

Monitor daily spending to prevent waste and impulsive purchases.

3. Consistent Saving

Set aside a fixed portion of income for emergencies and future goals.

4. Debt Monitoring

Avoid unnecessary borrowing and prioritize repayment.

5. Planned Giving

Include generosity as a fixed budget category.

Weekly and Monthly Financial Discipline Routine

Timeframe

Financial Actions

Daily

Track expenses

Weekly

Review spending habits

Monthly

Adjust budget

Quarterly

Review savings & debt

Annually

Long-term financial planning

Applying Biblical Principles to Major Financial Decisions

Financial Area

Biblical Application

Career choice

Ethical income

Investments

Responsible risk

Home purchase

Affordability planning

Education

Long-term saving

Business

Integrity-based operations

Common Financial Challenges and Biblical Solutions

Challenge

Biblical Principle

Solution

Overspending

Contentment

Controlled budgeting

Debt accumulation

Discipline

Expense reduction

Lack of savings

Foresight

Automated saving

Financial stress

Trust

Structured planning

Income instability

Diligence

Skill development

Why Daily Application Matters

Consistent application:

Builds disciplined financial habits

Reduces financial anxiety

Encourages ethical money decisions

Promotes long-term stability

Strengthens stewardship accountability

Biblical principles become effective only when practiced consistently, not occasionally.

Extractable Key Facts

Biblical money principles are applied through budgeting, saving, debt control, and generosity.

Daily financial discipline leads to long-term stability and peace.

Structured financial habits prevent overspending and debt accumulation.

Consistent application promotes ethical and responsible money management.

Summary

Applying Biblical Money Principles:

Daily financial habits based on biblical stewardship, planning, discipline, and generosity lead to financial stability, reduced stress, and responsible wealth management.

Key Takeaways

Daily discipline strengthens financial control

Structured planning promotes long-term success

Ethical decisions align faith and finance

Consistency builds financial stability

Pros & Cons of Faith-Based Financial Living

Pros

Ethical financial behavior

Reduced financial stress

Long-term stability

Purpose-driven money use

Cons

Requires discipline

Demands consistency

Common Mistakes & Misconceptions

Practicing biblical principles inconsistently

Ignoring budgeting discipline

Treating giving as optional

Delaying financial plannin

Common Misunderstandings About Biblical Finances

Why Misinterpretations Occur

Many financial misconceptions arise from partial scripture reading, cultural beliefs, modern consumer influences, and lack of contextual understanding. These misunderstandings often lead to financial imbalance, poor decision-making, and misplaced expectations.

Biblical financial teaching promotes balance, responsibility, discipline, and wisdom, not extremes of poverty or excessive wealth pursuit.

Top Biblical Finance Misconceptions Explained

Misconception

Reality

Biblical Explanation

Wealth is sinful

Wealth itself is neutral

The Bible condemns love of money, not money

Poverty is holiness

Financial stability is encouraged

Scripture promotes provision and planning

Debt is unavoidable

Debt is cautioned against

Debt creates financial burden

Giving causes loss

Giving promotes blessing

Generosity brings provision

Budgeting shows lack of faith

Planning is wise

Scripture encourages preparation

Misconception 1: Wealth Is Sinful

Reality:

The Bible does not condemn wealth. It warns against greed, materialism, and the love of money. Wealth is viewed as a resource for stewardship, generosity, and responsibility.

Correct Understanding:

Money becomes harmful only when it controls priorities and values.

Misconception 2: Poverty Equals Spirituality

Reality:

Scripture promotes provision, stability, and wise financial living, not forced poverty.

Correct Understanding:

Financial stability enables responsible stewardship, generosity, and family care.

Misconception 3: Debt Is Normal and Acceptable

Reality:

The Bible consistently warns that debt creates financial burden and dependence.

Correct Understanding:

Debt should be limited, cautious, and avoided where possible.

Misconception 4: Giving Leads to Financial Loss

Reality:

Biblical teaching associates generosity with spiritual and material provision.

Correct Understanding:

Planned giving promotes long-term stability, social well-being, and spiritual fulfillment.

Misconception 5: Budgeting Shows Lack of Faith

Reality:

The Bible repeatedly emphasizes planning, foresight, and financial preparation.

Correct Understanding:

Budgeting reflects wisdom, discipline, and stewardship, not doubt.

Common Financial Mistakes Caused by These Misconceptions

Overspending due to entitlement thinking

Neglecting saving and planning

Accumulating unnecessary debt

Ignoring generosity

Avoiding financial accountability

Extractable Key Facts

The Bible does not condemn wealth, but warns against greed.

Scripture promotes planning, saving, generosity, and financial discipline.

Debt is portrayed as financial burden.

Budgeting reflects wisdom and stewardship, not lack of faith.

Summary

Understanding Biblical Finance Correctly:

Biblical financial teaching encourages balance, discipline, generosity, and planning. Misunderstanding these principles can lead to financial instability and poor decision-making.

Key Takeaways

Wealth is a responsibility, not a sin

Poverty is not a spiritual requirement

Debt should be carefully managed or avoided

Planning strengthens financial stewardship

Common Pitfalls to Avoid

Extreme financial thinking

Neglecting budgeting

Misusing generosity

Ignoring discipline

Over-spiritualizing money decisions- Conclusion

The 7 Biblical Principles of Money Management provide a timeless, faith-based framework for handling finances with wisdom, discipline, integrity, and responsibility. Rooted in stewardship, honest earning, planning, saving, debt avoidance, generosity, and contentment, these principles guide individuals toward financial stability, ethical living, and long-term provision.

By applying biblical financial wisdom consistently, individuals can develop healthy money habits, reduce financial stress, avoid destructive debt, and create sustainable wealth while maintaining spiritual alignment. Biblical money management is not about accumulation—it is about responsible stewardship, purposeful living, and faithful financial decision-making.

Frequently Asked Questions (FAQs)

1. What are the 7 biblical principles of money management?

The seven principles are: stewardship, honest earning, wise budgeting, faithful saving, debt avoidance, generous giving, and contentment with financial discipline. These principles form a complete framework for responsible financial living based on biblical teachings.

2. What does the Bible say about managing money?

The Bible teaches that money should be managed wisely, ethically, and responsibly, emphasizing planning, discipline, generosity, and stewardship. Financial decisions are viewed as spiritual responsibilities that reflect faith and integrity.

3. Is debt considered sinful in the Bible?

The Bible does not directly label debt as sinful, but it strongly warns against it, stating that debt creates financial bondage and burden. Scripture encourages careful borrowing and promotes debt avoidance whenever possible.

4. What is biblical stewardship?

Biblical stewardship refers to the belief that God owns all resources, and humans are entrusted to manage money responsibly. It involves budgeting, saving, ethical earning, generosity, and disciplined financial behavior.

5. Does the Bible encourage saving money?

Yes. The Bible repeatedly promotes saving and preparation for future needs, emphasizing wisdom, foresight, and financial discipline to prevent hardship and instability.

6. What is tithing according to the Bible?

Tithing traditionally means giving 10% of income as an act of obedience, gratitude, and worship. It reflects disciplined generosity and trust in divine provision.

7. How can I apply biblical money principles in daily life?

You can apply them by budgeting monthly, saving consistently, avoiding debt, practicing generosity, earning ethically, and living contentedly, aligning financial habits with biblical teachings.

References (Credible & Authoritative Sources)

The Holy Bible (NIV, ESV, KJV Editions)

– Proverbs, Luke, Psalms, Romans, Corinthians, Timothy, Malachi

Crown Financial Ministries – Biblical Financial Stewardship Resources

https://www.crown.org

Dave Ramsey – Biblical Financial Principles

https://www.ramseysolutions.com

Christian Financial Concepts – Stewardship & Tithing

https://www.christianfinance.com

Blue Letter Bible – Scripture Research Platform

https://www.blueletterbible.org

Bible Gateway – Verse Research Database

https://www.biblegateway.com