FintechRevo is a digital financial technology platform designed to streamline payments, automate financial operations, and deliver secure, API-driven fintech services for individuals, startups, and enterprises. It integrates payment processing, financial automation, compliance tools, and data analytics into a unified cloud-based ecosystem.

Definition (Featured Snippet Ready – 45–55 words):

FintechRevo.com is a fintech platform that provides digital payment processing, financial automation, API integrations, and secure data management tools. It enables businesses and individuals to manage transactions, automate workflows, and access real-time financial insights through a scalable, cloud-based infrastructure built on modern compliance and security standards.

Company Vision & Mission

Vision:

To simplify financial operations through secure, intelligent, and scalable financial technology solutions.

Mission:

- Enable frictionless digital transactions

- Automate complex financial workflows

- Improve operational efficiency using AI-driven analytics

- Maintain enterprise-grade security and regulatory compliance

Strategic Focus Areas:

- Digital financial transformation

- API-first fintech architecture

- Embedded finance enablement

- Automation-driven cost optimization

Target Users

FintechRevo.com is designed for a wide range of user segments across multiple industries.

| User Category | Primary Needs | Platform Value |

|---|---|---|

| Individuals | Payments, budgeting, transfers | Secure & fast transactions |

| Small Businesses | Invoicing, payments, automation | Workflow efficiency |

| Startups | API banking, integrations | Rapid scalability |

| Enterprises | Finance automation, compliance | Operational optimization |

| Developers | APIs, fintech infrastructure | Custom financial solutions |

How FintechRevo.com Fits into the Fintech Ecosystem

- Operates as a financial technology layer, not a traditional bank

- Enables embedded finance capabilities

- Integrates banking APIs, payment gateways, and compliance tools

- Supports open banking models and cloud-native deployments

🔹 Summary

What is FintechRevo.com?

FintechRevo.com is a cloud-based fintech platform offering payment processing, financial automation, secure APIs, and real-time analytics for individuals and businesses. It focuses on operational efficiency, compliance, scalability, and AI-powered financial intelligence.

🔹 Key Takeaways

- FintechRevo.com is a multi-functional fintech ecosystem, not just a payment platform.

- It supports digital payments, automation, integrations, and compliance management.

- Built for scalability, security, and API-driven financial operations.

- Serves individual users, businesses, developers, and enterprises.

Quick Facts

- FintechRevo.com provides digital payments, automation, and API-based fintech services.

- Designed for business efficiency, security, and financial scalability.

- Supports real-time analytics, compliance frameworks, and system integrations.

How FintechRevo.com Works

Platform Architecture Overview

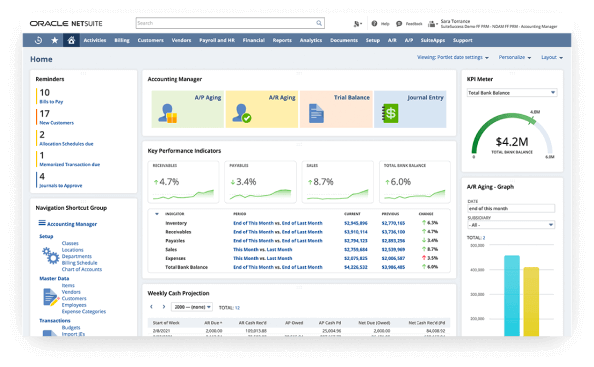

FintechRevo.com operates on a cloud-native, API-first fintech architecture that connects users, businesses, banks, and payment networks through a centralized digital infrastructure. The platform integrates payment gateways, banking APIs, financial automation engines, compliance modules, and AI-based analytics into a unified system.

Core Architectural Components:

- API gateway for secure system connectivity

- Cloud-based transaction processing engine

- Data encryption and security middleware

- Compliance and regulatory monitoring layer

- AI-driven financial analytics module

Architecture Model:

User Interface → Secure API Layer → Transaction Engine → Banking & Payment Networks → Analytics & Compliance Systems

User Workflow Process

FintechRevo.com follows a structured operational workflow that ensures speed, accuracy, and regulatory compliance throughout each financial transaction.

| Step | Process Stage | Function |

|---|---|---|

| 1 | User Authentication | Secure login & identity verification |

| 2 | Transaction Initiation | Payment, transfer, or financial request |

| 3 | API Processing | Secure data transmission |

| 4 | Validation & Compliance | KYC, AML, and risk checks |

| 5 | Transaction Execution | Payment or transfer processing |

| 6 | Confirmation & Reporting | Real-time status & analytics |

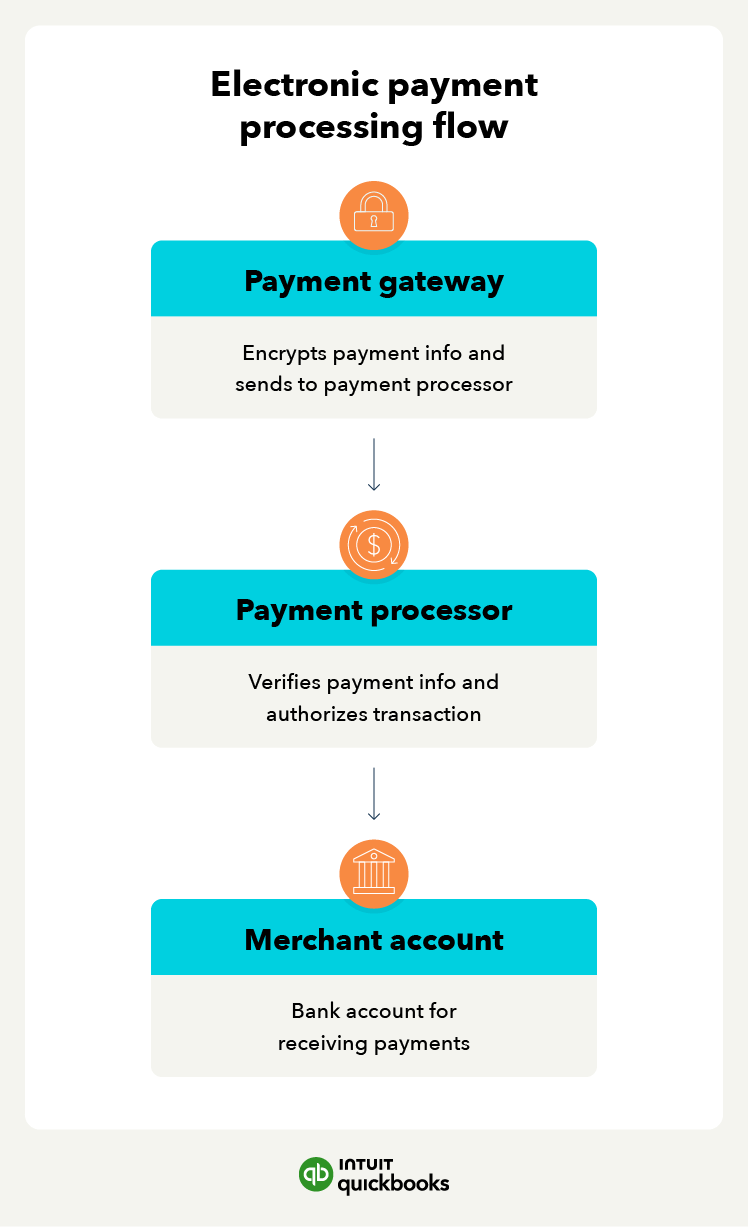

Transaction & Data Flow Model

The platform follows a real-time transaction and data synchronization model that ensures low latency, high security, and regulatory compliance.

Transaction Flow:

- User submits payment or request

- System validates identity and transaction parameters

- API layer routes request to financial network

- Transaction engine executes payment

- Compliance module logs and audits data

- Real-time confirmation delivered to the user

Key Operational Metrics:

- Real-time processing

- High system uptime

- Low-latency API responses

- Continuous compliance monitoring

How Financial Automation Works

FintechRevo.com automates repetitive financial tasks using rule-based workflows and AI-powered decision engines.

Automated Functions Include:

- Invoice processing

- Recurring payments

- Financial reconciliation

- Compliance reporting

- Fraud detection alerts

This reduces manual workload, improves accuracy, and enhances financial visibility.

Security Layer Integration in Workflow

Every operational step is protected through:

- End-to-end encryption

- Multi-factor authentication (MFA)

- Tokenized payment credentials

- Continuous transaction monitoring

- Real-time fraud detection

This ensures data integrity, transaction security, and regulatory adherence.

🔹 Summary

FintechRevo.com operates through a cloud-based, API-driven fintech architecture that securely processes transactions, automates workflows, ensures regulatory compliance, and delivers real-time financial insights. Its system integrates authentication, transaction processing, security enforcement, and analytics into one unified digital platform.

🔹 Key Takeaways

- Operates using API-first fintech infrastructure

- Supports real-time financial transactions and automation

- Implements continuous security and compliance checks

- Designed for scalability, speed, and reliability

- Uses AI-powered analytics for financial intelligence

Quick Answers

- FintechRevo.com works through a secure, cloud-based API architecture that connects users, banks, and payment networks.

- It processes transactions in real time with built-in compliance and fraud prevention systems.

- Financial workflows are automated using AI-driven analytics and rule-based engines.

How does FintechRevo.com process transactions?

Through secure APIs, cloud-based transaction engines, real-time compliance validation, and encrypted financial data routing.

Is FintechRevo.com real-time?

Yes, it supports real-time payment processing, analytics updates, and transaction confirmations.

Core Features of FintechRevo.com

Payment Processing

FintechRevo.com provides a secure, fast, and scalable digital payment processing system that supports real-time transactions across multiple payment channels. The platform is designed to handle high transaction volumes with minimal latency while ensuring compliance with financial regulations.

Key Capabilities:

- Real-time payment execution

- Multi-channel transaction support

- Automated payment routing

- Secure transaction authentication

- Instant confirmation and reporting

Operational Benefits:

- Faster settlement cycles

- Reduced transaction failures

- Improved payment reliability

Financial Automation Tools

The platform includes workflow automation systems that streamline repetitive financial tasks, reducing manual processing and operational overhead.

Automated Financial Functions:

- Invoice generation and reconciliation

- Recurring billing and subscriptions

- Expense tracking and categorization

- Automated accounting synchronization

- Compliance reporting automation

Automation Impact:

- Improved financial accuracy

- Reduced administrative workload

- Faster financial closing cycles

API & System Integrations

FintechRevo.com operates on an API-first architecture, enabling seamless integration with banking systems, payment gateways, accounting software, and enterprise platforms.

| Integration Category | Supported Functions |

|---|---|

| Banking APIs | Account access, transfers, verification |

| Payment Gateways | Transaction processing, settlements |

| Accounting Systems | Real-time financial sync |

| ERP Platforms | Enterprise workflow automation |

| E-commerce Platforms | Checkout & payment automation |

Integration Advantages:

- Rapid system connectivity

- Custom financial workflow development

- Embedded finance enablement

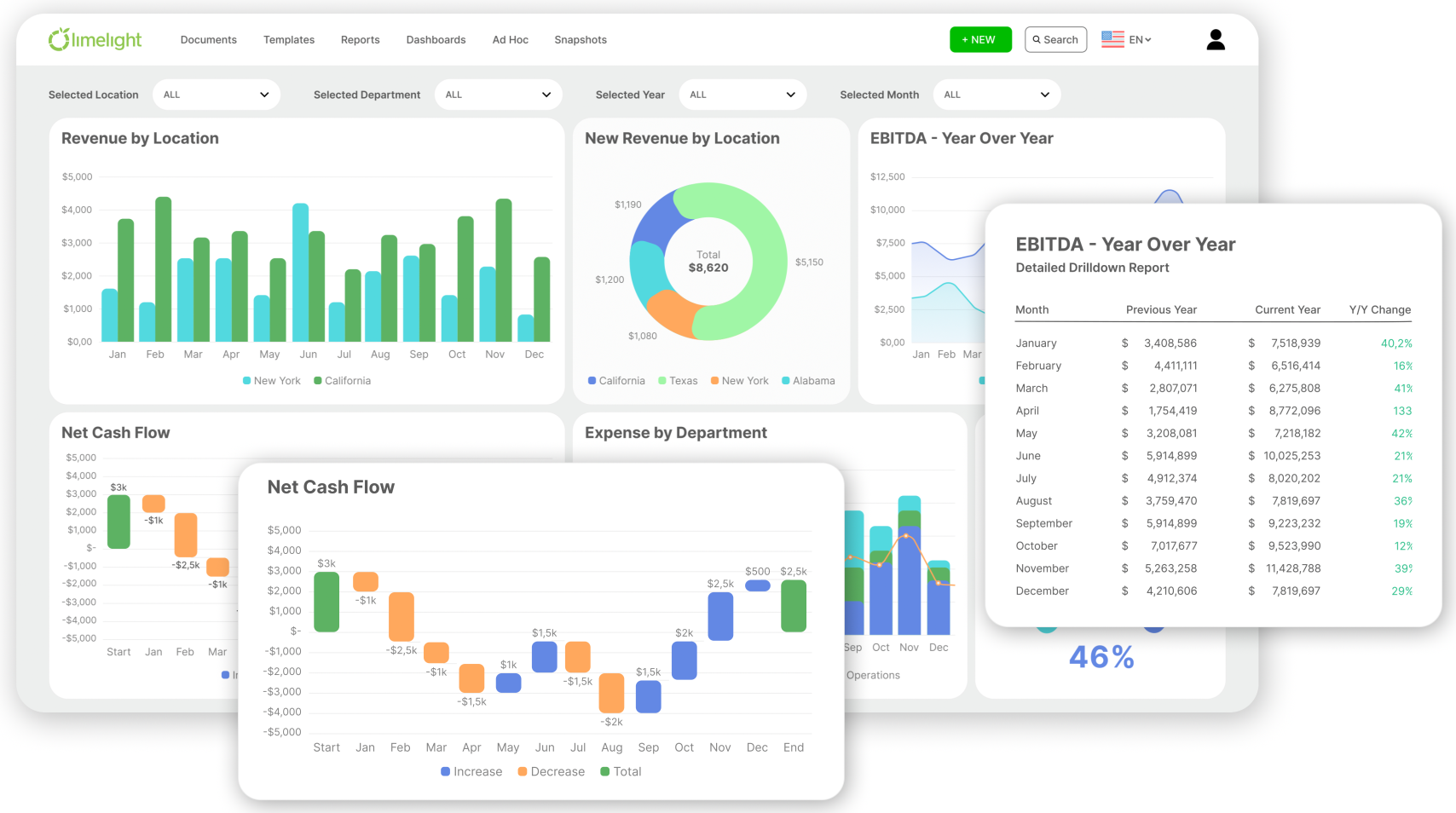

AI-Powered Financial Insights

The platform uses machine learning and predictive analytics to provide actionable financial insights and risk intelligence.

AI-Driven Capabilities:

- Cash flow forecasting

- Spending pattern analysis

- Fraud detection modeling

- Risk scoring

- Financial trend predictions

Data Outputs:

- Real-time dashboards

- Automated alerts

- Predictive financial recommendations

Security & Risk Management Tools

Security is embedded at every operational layer using enterprise-grade cybersecurity and financial risk management systems.

Core Security Features:

- End-to-end data encryption

- Multi-factor authentication (MFA)

- Tokenization of payment credentials

- Continuous transaction monitoring

- Automated fraud detection

Risk Management Functions:

- Transaction anomaly detection

- Real-time compliance checks

- Behavioral analytics

- Risk scoring models

🔹 Summary

FintechRevo.com combines payment processing, financial automation, API integrations, AI-powered analytics, and advanced security systems into a unified fintech platform. These features enable businesses and individuals to manage transactions efficiently, automate workflows, and maintain regulatory compliance while benefiting from real-time financial insights.

🔹 Key Takeaways

- Supports real-time digital payment processing

- Automates financial operations and compliance workflows

- Provides secure API integrations for system connectivity

- Uses AI-driven analytics for financial intelligence

- Implements enterprise-grade security and fraud prevention

Extractable Facts

- FintechRevo.com offers payment processing, automation, APIs, AI insights, and advanced security tools.

- The platform enables real-time transactions, predictive analytics, and compliance automation.

- Built on cloud-based, API-first fintech architecture for scalability and system integration.

Direct Answers

What features does FintechRevo.com offer?

FintechRevo.com provides payment processing, financial automation, secure APIs, AI-powered analytics, and enterprise-grade security tools.

Does FintechRevo.com support automation?

Yes, it automates invoicing, billing, accounting synchronization, compliance reporting, and transaction reconciliation.

Read the blog:Fintech

Services Offered by FintechRevo.com

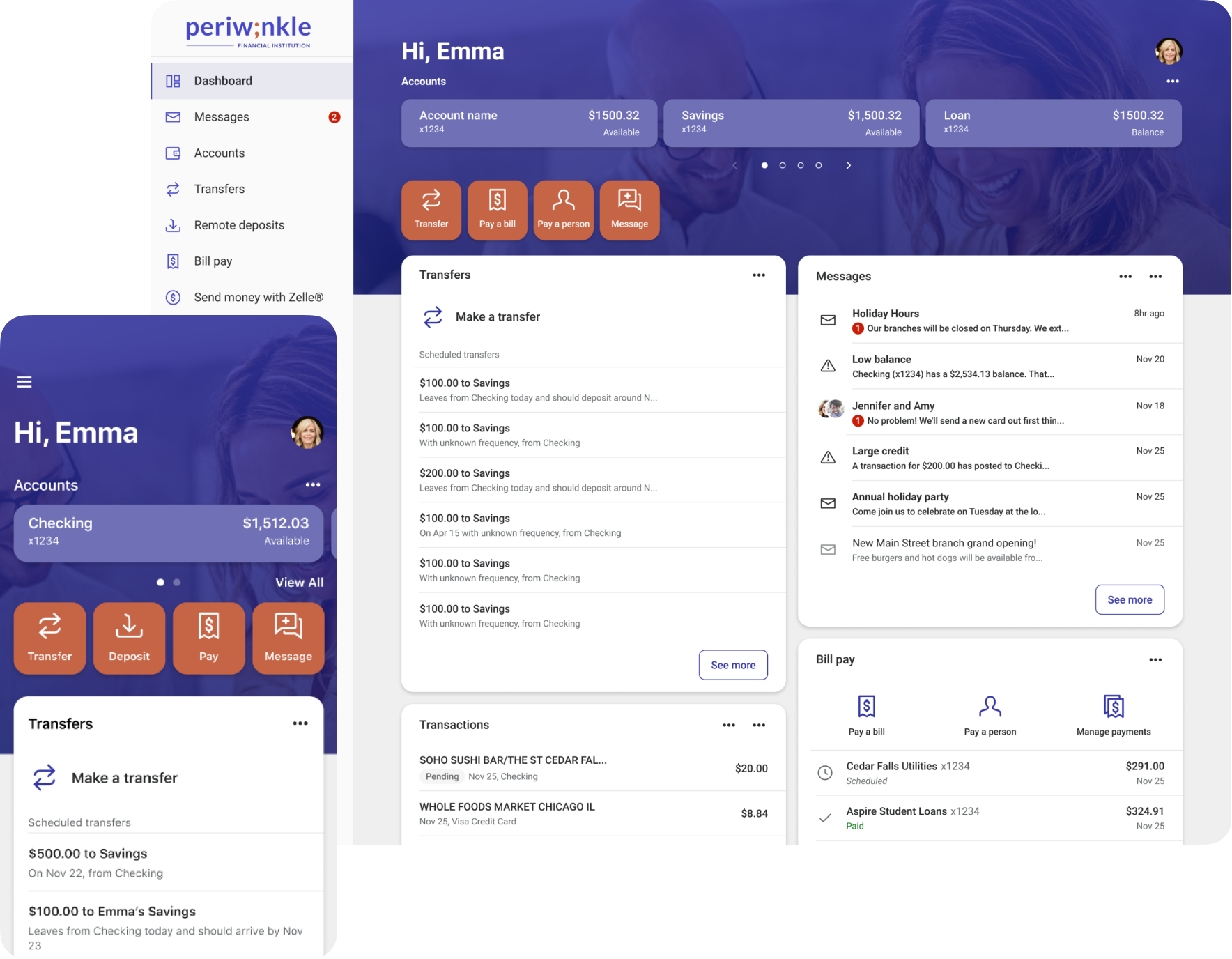

Digital Banking Services

FintechRevo.com provides digital banking infrastructure services that enable users and businesses to perform essential financial operations through a unified digital interface. These services are designed to support real-time transactions, secure account management, and seamless banking connectivity.

Core Digital Banking Functions:

- Account management dashboards

- Real-time balance tracking

- Secure fund transfers

- Transaction history and reporting

- Automated reconciliation

Service Value:

- Faster transaction execution

- Improved financial visibility

- Reduced dependency on manual banking processes

Merchant Payment Solutions

The platform delivers end-to-end merchant payment processing services that support online, mobile, and API-based payment acceptance.

Merchant Services Include:

- Online checkout integrations

- Payment gateway connectivity

- Subscription billing management

- Multi-currency transaction handling

- Automated settlement processing

Operational Benefits:

- Higher transaction success rates

- Reduced checkout friction

- Improved payment reliability

- Faster fund settlements

Business Finance Tools

FintechRevo.com offers a suite of financial management and automation tools designed to optimize business finance operations.

| Business Function | Service Capability |

|---|---|

| Invoicing | Automated invoice creation & tracking |

| Expense Management | Categorization & reporting |

| Payroll Processing | Automated salary disbursements |

| Financial Reporting | Real-time analytics dashboards |

| Cash Flow Management | Predictive forecasting |

Business Impact:

- Improved financial control

- Reduced administrative workload

- Enhanced reporting accuracy

Cross-Border Payment Capabilities

The platform supports international payment processing with currency conversion, regulatory compliance, and transaction transparency.

Cross-Border Features:

- Multi-currency payment support

- Automated FX conversion

- International settlement processing

- Compliance screening

- Transaction traceability

Use Cases:

- International e-commerce payments

- Freelancer and contractor payouts

- Global supplier transactions

- Cross-border subscription billing

Compliance & Regulatory Services

FintechRevo.com integrates regulatory compliance services that ensure transactions align with global financial regulations and industry standards.

Compliance Services Include:

- KYC identity verification

- AML transaction monitoring

- Risk scoring systems

- Regulatory reporting automation

- Audit trail generation

Compliance Value:

- Reduced regulatory risk

- Enhanced transaction transparency

- Improved operational trust

🔹 Summary

FintechRevo.com delivers comprehensive fintech services including digital banking operations, merchant payment processing, business finance automation, international payments, and regulatory compliance management. These services collectively support efficient, secure, and scalable financial operations for individuals and organizations.

🔹 Key Takeaways

- Provides digital banking and payment services

- Supports merchant payment acceptance and settlements

- Automates business finance operations

- Enables cross-border financial transactions

- Ensures continuous regulatory compliance

Extractable Facts

- FintechRevo.com offers digital banking, payment processing, business finance tools, international payments, and compliance services.

- The platform enables secure, real-time, and automated financial operations.

- Services are designed for scalability, compliance, and operational efficiency.

- PAA Alignment – Direct Answers

What services does FintechRevo.com provide?

FintechRevo.com provides digital banking, payment processing, business finance automation, international payments, and regulatory compliance services.

Does FintechRevo.com support international transactions?

Yes, the platform enables secure cross-border payments with currency conversion and compliance monitoring.

FintechRevo.com for Businesses vs Individuals

Business Use Cases

FintechRevo is designed to support end-to-end financial operations for businesses, ranging from startups to large enterprises. Its API-driven infrastructure, automation tools, and compliance systems enable organizations to streamline payments, manage cash flow, and automate financial workflows.

Primary Business Applications:

Payment collection and disbursement

Automated invoicing and reconciliation

Subscription billing management

Payroll processing and contractor payouts

Real-time financial reporting

Operational Benefits for Businesses:

Reduced manual processing

Improved transaction accuracy

Faster settlement cycles

Enhanced compliance management

Scalable financial infrastructure

Common Business Scenarios:

E-commerce transaction processing

SaaS subscription billing

Marketplace payout automation

International supplier payments

Financial data synchronization with ERP systems

Personal Finance Applications

For individuals, FintechRevo.com provides secure, fast, and user-friendly digital financial services that support everyday financial needs and personal money management.

Core Personal Use Cases:

Peer-to-peer transfers

Bill payments

Transaction monitoring

Expense tracking

Budget planning

User Benefits:

Faster transactions

Improved spending visibility

Simplified money management

Secure digital payments

Real-time transaction notifications

Startup & Enterprise Solutions

The platform delivers scalable fintech infrastructure tailored for both startups and enterprise organizations.

Organization Type

Key Needs

FintechRevo Solutions

Startups

Fast deployment, APIs, scalability

Plug-and-play fintech APIs, automation

SMEs

Cost efficiency, workflow automation

Payment tools, invoicing, reporting

Enterprises

Compliance, security, scale

Advanced security, analytics, compliance frameworks

Enterprise Capabilities:

High-volume transaction processing

Advanced compliance reporting

Custom API integrations

Dedicated security architecture

Scalable cloud deployment

Comparison: Business vs Individual Platform Capabilities

Feature Area

Businesses

Individuals

Payments

High-volume, multi-channel

P2P, bill payments

Automation

Advanced workflows

Basic automation

Compliance

Full regulatory monitoring

Basic identity checks

Reporting

Enterprise-grade analytics

Personal expense tracking

Integrations

ERP, accounting, APIs

Mobile and web apps

🔹 Summary - FintechRevo.com supports both business and individual financial needs. Businesses benefit from automation, scalability, and compliance tools, while individuals gain access to secure digital payments, expense tracking, and simplified money management. The platform adapts its infrastructure to serve diverse financial workflows across user segments.

🔹 Key Takeaways

Businesses use FintechRevo.com for payments, automation, compliance, and financial reporting.

Individuals use the platform for transfers, bill payments, and personal finance management.

Startups benefit from API-first fintech infrastructure, while enterprises leverage security and compliance systems.

Extractable Facts

FintechRevo.com supports business finance automation and personal digital payments.

Businesses gain scalable APIs, compliance tools, and workflow automation.

Individuals benefit from secure transactions, expense tracking, and real-time reporting.

PAA Alignment – Direct Answers

Who should use FintechRevo.com?

FintechRevo.com is suitable for individuals, startups, small businesses, and enterprises seeking secure digital payments, financial automation, and real-time financial insights.

Is FintechRevo.com for businesses only?

No, the platform supports both business operations and personal finance use cases. - (Digital Banking • Merchant Payments • Business Finance • Cross-Border Payments • Compliance)

Security, Privacy & Regulatory Compliance

Data Security Framework

FintechRevo.com operates on a multi-layered cybersecurity framework designed to protect financial data, user identities, and transaction records. The platform applies enterprise-grade security protocols to ensure confidentiality, integrity, and availability of sensitive financial information.

Core Security Mechanisms:

- End-to-end data encryption (in transit & at rest)

- Tokenization of payment credentials

- Secure API gateways

- Network firewalls and intrusion detection systems

- Continuous vulnerability monitoring

Security Architecture Model:

User Interface → Encrypted API Layer → Secure Processing Engine → Protected Data Storage → Compliance & Audit Systems

Security Objectives:

- Prevent unauthorized access

- Protect transactional integrity

- Ensure system availability

- Maintain regulatory compliance

Privacy Protection & Data Governance

FintechRevo.com applies strict data governance and privacy management policies aligned with global data protection frameworks.

Privacy Controls Include:

- Role-based access control (RBAC)

- Data minimization practices

- Secure identity management

- Encrypted user data storage

- Continuous privacy audits

Privacy Principles Applied:

- Data transparency

- Purpose limitation

- Secure storage

- Controlled data sharing

- Regulatory adherence

Regulatory Standards & Compliance Framework

The platform integrates global financial compliance standards to ensure legal, ethical, and regulatory conformity across jurisdictions.

| Compliance Standard | Purpose |

|---|---|

| PCI DSS | Secure card payment processing |

| ISO 27001 | Information security management |

| GDPR | Data privacy and protection |

| SOC 2 | Operational security controls |

| AML | Anti-money laundering monitoring |

| KYC | Identity verification |

Compliance Capabilities:

- Automated identity verification

- Continuous transaction screening

- Regulatory reporting automation

- Audit trail generation

- Risk scoring systems

Fraud Prevention & Risk Monitoring Systems

FintechRevo.com deploys AI-powered fraud detection and risk intelligence systems that continuously monitor transaction behavior and financial patterns.

Fraud Prevention Features:

- Behavioral transaction analysis

- Anomaly detection algorithms

- Real-time transaction scoring

- Automated risk alerts

- Adaptive fraud prevention rules

Risk Monitoring Objectives:

- Prevent unauthorized payments

- Detect suspicious activity

- Reduce financial losses

- Ensure regulatory alignment

Security Operations Lifecycle

| Phase | Security Function |

|---|---|

| Prevention | Encryption, authentication, access control |

| Detection | Real-time monitoring, AI-based alerts |

| Response | Automated blocking, risk escalation |

| Recovery | Data backup, incident resolution |

| Audit | Continuous compliance logging |

Summary

FintechRevo.com applies enterprise-grade cybersecurity, strict privacy controls, and international compliance standards to protect user data and financial transactions. Through encryption, AI-powered fraud detection, and regulatory monitoring, the platform ensures secure, transparent, and legally compliant financial operations.

🔹 Key Takeaways

- Implements multi-layered cybersecurity architecture

- Uses end-to-end encryption and tokenization

- Follows global compliance frameworks (PCI DSS, ISO 27001, GDPR, SOC 2)

- Applies AI-driven fraud detection and risk scoring

- Ensures continuous regulatory monitoring and auditing

Extractable Facts

- FintechRevo.com uses enterprise-grade encryption, fraud detection, and regulatory compliance systems.

- The platform aligns with global security and privacy standards.

- AI-powered monitoring ensures real-time fraud prevention and risk control.

Direct Answers

Is FintechRevo.com secure?

Yes, FintechRevo.com uses encryption, tokenization, AI-based fraud detection, and global compliance standards to ensure secure financial transactions and data protection.

Does FintechRevo.com follow regulatory standards?

Yes, the platform aligns with PCI DSS, ISO 27001, GDPR, SOC 2, AML, and KYC compliance frameworks.

Technology Stack & Platform Integrations

API Infrastructure & System Architecture

FintechRevo.com is built on a cloud-native, API-first technology stack designed for scalability, reliability, and interoperability. Its architecture enables seamless communication between banking systems, payment gateways, enterprise software, and third-party applications.

Core Infrastructure Components:

- Secure RESTful and webhook APIs

- Microservices-based backend architecture

- Cloud computing environments

- Distributed data processing engines

- Load-balanced transaction routing systems

Technical Objectives:

- High availability

- Low-latency transaction processing

- Horizontal scalability

- Secure data exchange

- Fault-tolerant operations

Banking System Integrations

The platform integrates directly with banking networks and financial institutions to enable real-time account access, fund transfers, and transaction verification.

Banking Integration Capabilities:

- Account authentication

- Balance retrieval

- Fund transfers

- Transaction confirmation

- Regulatory reporting

Operational Advantages:

- Faster settlement

- Real-time banking connectivity

- Reduced intermediary dependency

Payment Gateway & Financial Network Connectivity

FintechRevo.com supports multi-gateway integration for global payment acceptance and processing.

| Integration Category | Supported Capabilities |

|---|---|

| Card Networks | Credit & debit card payments |

| Digital Wallets | Mobile & web wallet processing |

| Bank Transfers | ACH & real-time transfers |

| Cross-Border Networks | International settlements |

Integration Benefits:

- Higher transaction success rates

- Improved payment reliability

- Expanded payment method support

Accounting, ERP & Business Platform Integrations

The platform provides native and API-based integrations with accounting systems, enterprise resource planning (ERP) platforms, and business management tools.

Supported Business Integrations:

- Accounting software synchronization

- ERP financial workflow automation

- CRM billing connectivity

- Subscription management systems

- Payroll platforms

Operational Outcomes:

- Automated bookkeeping

- Real-time financial reporting

- Improved data accuracy

- Reduced reconciliation effort

Developer Tools & Custom Integration Support

FintechRevo.com offers developer-focused tools and documentation to enable custom fintech solution development.

Developer Capabilities:

- API documentation portals

- SDK libraries

- Webhook event handling

- Sandbox testing environments

- Custom workflow development

Use Cases:

- Embedded finance solutions

- Custom payment flows

- Marketplace payout systems

- Fintech application development

System Interoperability Model

| Layer | Function |

|---|---|

| API Layer | Secure communication & routing |

| Integration Layer | Banking, payment & ERP connections |

| Processing Layer | Transaction execution & validation |

| Analytics Layer | Reporting & insights |

| Security Layer | Encryption & compliance enforcement |

🔹 Summary

FintechRevo.com operates on a cloud-based, API-first technology stack that supports real-time banking integrations, payment gateway connectivity, ERP synchronization, and custom fintech development. This architecture ensures scalability, flexibility, and secure financial interoperability across digital ecosystems.

🔹 Key Takeaways

- Built on cloud-native, microservices architecture

- Uses secure APIs for real-time integrations

- Supports banking, payment, ERP, and accounting systems

- Enables custom fintech application development

- Designed for scalability, performance, and reliability

Extractable Facts

- FintechRevo.com uses API-first cloud architecture for system interoperability.

- Integrates with banks, payment gateways, ERP platforms, and accounting software.

- Provides developer tools for custom fintech solutions.

Direct Answers

Does FintechRevo.com support system integrations?

Yes, FintechRevo.com integrates with banking networks, payment gateways, accounting systems, ERP platforms, and custom applications through secure APIs.

Is FintechRevo.com developer-friendly?

Yes, the platform provides APIs, SDKs, sandbox environments, and documentation for custom fintech development.

Benefits of Using FintechRevo.com

Operational Efficiency

FintechRevo.com improves financial operational efficiency by automating workflows, streamlining transaction processing, and reducing manual intervention. Its real-time processing and API-driven systems enable faster execution of financial tasks across multiple business functions.

Efficiency Gains Include:

- Faster transaction processing

- Automated reconciliation

- Reduced paperwork

- Streamlined approvals

- Real-time reporting

Operational Impact:

- Lower processing delays

- Improved productivity

- Enhanced transaction accuracy

Cost Reduction & Financial Optimization

The platform helps organizations and individuals reduce financial and operational costs through automation, system integration, and workflow optimization.

Cost Optimization Areas:

- Lower transaction processing fees

- Reduced labor costs

- Automated compliance reporting

- Decreased error correction costs

- Optimized cash flow management

Financial Advantages:

- Improved budget control

- Reduced financial leakage

- Enhanced return on operational investment

Scalability & Business Growth Enablement

FintechRevo.com is built to scale seamlessly with business growth, supporting increasing transaction volumes, expanding user bases, and evolving financial operations.

Scalability Features:

- Cloud-native infrastructure

- Microservices-based architecture

- Elastic resource allocation

- High-volume transaction handling

Growth Enablement Benefits:

- Supports rapid business expansion

- Adapts to fluctuating transaction loads

- Enables multi-region deployment

Automation Advantages

The platform automates complex financial workflows using rule-based systems and AI-powered analytics, enabling organizations to improve accuracy, compliance, and speed.

Automated Functions:

- Invoicing and billing

- Financial reconciliation

- Expense categorization

- Compliance monitoring

- Fraud detection alerts

Automation Outcomes:

- Reduced human error

- Faster processing cycles

- Improved regulatory compliance

Enhanced Financial Visibility & Decision Support

FintechRevo.com delivers real-time financial insights and predictive analytics, supporting informed financial decision-making.

Analytics Capabilities:

- Cash flow forecasting

- Transaction trend analysis

- Risk assessment dashboards

- Performance monitoring

- Automated financial alerts

Decision-Making Benefits:

- Improved financial planning

- Proactive risk mitigation

- Enhanced strategic forecasting

Benefits Comparison Table

| Benefit Category | Platform Impact |

|---|---|

| Efficiency | Faster workflows & transactions |

| Cost | Lower operational expenses |

| Scalability | Supports business growth |

| Automation | Reduced manual effort |

| Visibility | Real-time financial insights |

| Compliance | Reduced regulatory risk |

🔹 Summary

FintechRevo.com delivers measurable business and user benefits through automation, operational efficiency, scalability, cost reduction, and real-time financial intelligence. Its cloud-based fintech infrastructure enables organizations and individuals to streamline financial operations while maintaining security, compliance, and performance.

🔹 Key Takeaways

- Improves financial operational efficiency

- Reduces costs through automation and optimization

- Enables scalable financial operations

- Enhances decision-making using real-time analytics

- Strengthens compliance and risk management

Extractable Facts

- FintechRevo.com improves efficiency, cost control, scalability, automation, and financial visibility.

- The platform enables real-time analytics, workflow automation, and secure financial operations.

- Designed to support business growth and financial optimization.

PAA Alignment – Direct Answers

What are the benefits of using FintechRevo.com?

FintechRevo.com provides operational efficiency, cost reduction, automation, scalability, and real-time financial insights for individuals and businesses.

Does FintechRevo.com help businesses scale?

Yes, its cloud-native architecture and API-driven infrastructure support high-volume transactions and rapid business expansion.

Limitations & Potential Drawbacks

Platform Constraints

While FintechRevo.com offers advanced fintech capabilities, certain operational and technical limitations may apply depending on user needs and geographic availability.

Common Platform Constraints:

- API integration complexity for non-technical users

- Advanced setup required for enterprise-grade features

- Dependence on third-party banking infrastructure

- Learning curve for automation tools

H3: Regulatory & Regional Availability Limitations

Fintech platforms must comply with local and international regulations, which may restrict feature availability in certain regions.

Possible Limitations:

- Cross-border compliance restrictions

- Limited banking integrations in specific countries

- Regulatory onboarding requirements

- Jurisdiction-based transaction limits

Market & Operational Challenges

- Competitive fintech ecosystem

- Continuous regulatory updates

- Infrastructure scaling costs

- Third-party dependency risks

Limitations Overview Table

| Limitation Category | Impact |

|---|---|

| Technical Complexity | Requires onboarding & setup |

| Regional Compliance | Feature restrictions |

| Market Competition | High differentiation required |

| Infrastructure Costs | Scaling investment |

🔹 Summary Box – Limitations

FintechRevo.com may face technical onboarding complexity, regulatory limitations, and geographic restrictions, particularly for advanced features and international operations.

🔹 Key Takeaways

- Advanced fintech tools require technical configuration

- Regulatory compliance may limit availability in some regions

- Platform performance depends on third-party integrations

FintechRevo.com vs Other Fintech Platforms

H3: Feature Comparison

| Feature | FintechRevo | Traditional Fintech Apps | Banks |

|---|---|---|---|

| API Integrations | Advanced | Limited | Minimal |

| Automation | High | Medium | Low |

| AI Analytics | Yes | Partial | No |

| Compliance Tools | Advanced | Basic | High |

| Customization | Extensive | Limited | Very Low |

Security & Compliance Comparison

| Platform | Security Level | Compliance Coverage |

|---|---|---|

| FintechRevo | Enterprise-grade | Global standards |

| Typical Fintech Apps | Moderate | Partial |

| Traditional Banks | High | High |

Pricing Model Comparison

| Platform Type | Cost Structure |

|---|---|

| FintechRevo | Usage-based, scalable |

| Banks | Fixed + transaction fees |

| Legacy Fintech Tools | Subscription-based |

🔹 Summary

FintechRevo.com offers stronger automation, integration, and scalability than most fintech platforms, positioning itself between traditional banks and advanced fintech SaaS infrastructure.

🔹 Key Takeaways

- More flexible and scalable than traditional banking systems

- Provides deeper automation than standard fintech apps

- Stronger API and developer capabilities

Who Should Use FintechRevo.com?

H3: Best User Profiles

- Digital-first businesses

- E-commerce companies

- SaaS platforms

- Marketplaces

- Startups

- Enterprises

- Developers

- Freelancers

- International businesses

Industry Applications

| Industry | Use Case |

|---|---|

| E-commerce | Payment processing |

| SaaS | Subscription billing |

| Marketplaces | Vendor payouts |

| Logistics | Supplier payments |

| Freelancing | Global payouts |

| Education | Tuition processing |

| Healthcare | Billing automation |

🔹 Summary

FintechRevo.com is ideal for businesses, startups, developers, and enterprises seeking secure, automated, scalable, and API-driven financial operations.

🔹 Key Takeaways

- Suitable for digital businesses and enterprises

- Ideal for automation-focused financial workflows

- Supports cross-border operations and system integrations

🔚 Conclusion

FintechRevo.com represents a modern fintech infrastructure platform that combines digital payments, financial automation, API-based integrations, compliance management, and AI-powered analytics into a unified ecosystem. Its cloud-native architecture enables scalable, secure, and efficient financial operations for individuals, startups, and enterprises. By bridging traditional banking systems with modern technology, FintechRevo.com supports the evolution of digital finance, operational efficiency, and data-driven financial decision-making.

❓ Frequently Asked Questions (FAQs)

1. What is FintechRevo.com used for?

FintechRevo.com is used for digital payments, financial automation, business finance management, API integrations, and compliance-driven transaction processing.

2. Is FintechRevo.com secure and legitimate?

Yes. The platform implements encryption, tokenization, fraud detection, and compliance standards such as PCI DSS, ISO 27001, GDPR, AML, and KYC.

3. Does FintechRevo.com support international payments?

Yes. It provides cross-border payment processing, currency conversion, compliance screening, and international settlement services.

4. Can developers integrate FintechRevo.com APIs?

Yes. The platform offers API documentation, SDKs, sandbox testing environments, and developer tools.

5. Is FintechRevo.com suitable for startups?

Yes. Startups benefit from scalable APIs, automation tools, and fast fintech deployment capabilities.

6. Does FintechRevo.com replace traditional banks?

No. It complements banking infrastructure by providing technology-driven financial automation and integration layers.

7. What industries benefit most from FintechRevo.com?

E-commerce, SaaS, marketplaces, logistics, freelancing, education, healthcare, and financial services.

📚 References (Credible Industry Sources)

Deloitte – Fintech Security & Compliance Framework

PCI Security Standards Council – https://www.pcisecuritystandards.org

ISO/IEC 27001 Information Security – https://www.iso.org/isoiec-27001-information-security.html

GDPR Official Portal – https://gdpr.eu

Open Banking Standards – https://www.openbanking.org.uk

World Economic Forum – Fintech & Financial Innovation

McKinsey & Company – Global Payments & Fintech Reports